[Spot Market] The price of semi-coke has been rising all the way, and at the end of the month, the prices of small-sized materials in the Shenmu and Fugu areas were mostly in the range of 1400-1500 CNY/T; The ex-factory price of silica has slightly increased to around 220-260 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The electricity prices in the main production areas ranged from 0.42 to 0.53 CNY/kWh. The spot price of ferrosilicon was supported by the rising cost of raw materials, at the end of the month, the quotation for 72# ferrosilicon standard blocks in the main production areas was mostly around 7200-7300 CNY/T, while the quotation for 75# ferrosilicon standard blocks was mostly around 7500-7600 CNY/T. HBIS Group's tender price for 75B ferrosilicon in October was set at 7700 CNY/T, an increase of 250 CNY/T compared to the previous month, with a volume of 1530 tons; The tender price for ferrosilicon at Fujian Sangang Group in October was 7750 CNY/T, an increase of 250 CNY/T compared to the previous month, with a volume of 2000 tons. The tone of the steel tender before the holiday has been set, higher than market expectations, further driving up positive sentiment. The supply side of ferrosilicon remained stable, and with profit recovery, there was still room for growth in production.

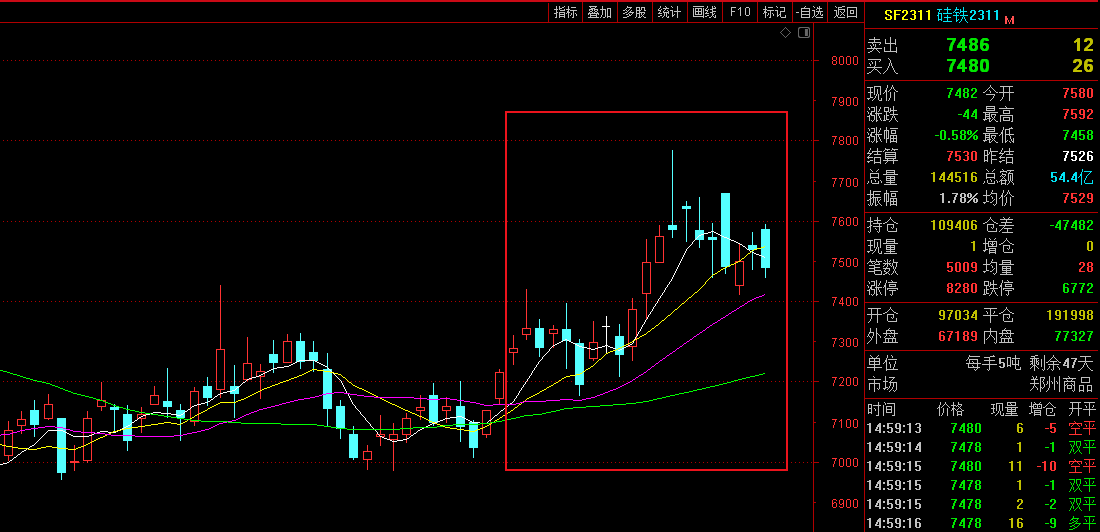

[Futures Market] The monthly opening price of main contract 2311 was 7274, the highest price was 7776, the lowest price was 7164, the closing price was 7482, the settlement price was 7530, the trading volume was 4086618, and the position was 109406, an increase of 3.57%.

[Export Data] According to data of China Customs, in August 2023, China exported 27900.512 tons of ferrosilicon (containing by weight more than 55% of silicon), an increase of 3002.22 tons or 12.06% compared to the previous month; A year-on-year decrease of 13954.072 tons, a decrease of 33.34%; In August 2023, China exported 2466 tons of ferrosilicon (containing by weight ≤55% of silicon), a decrease of 247.327 tons or 9.12% compared to the previous month; A year-on-year increase of 305.2 tons, with a growth rate of 14.12%. From January to August 2023, China exported 18317.582 tons of ferrosilicon (containing by weight ≤55% of silicon), an increase of 652.505 tons year-on-year or 3.69%; from January to August 2023, China exported 18317.582 tons of ferrosilicon (containing by weight ≤55% of silicon), an increase of 652.505 tons year-on-year or 3.69%.

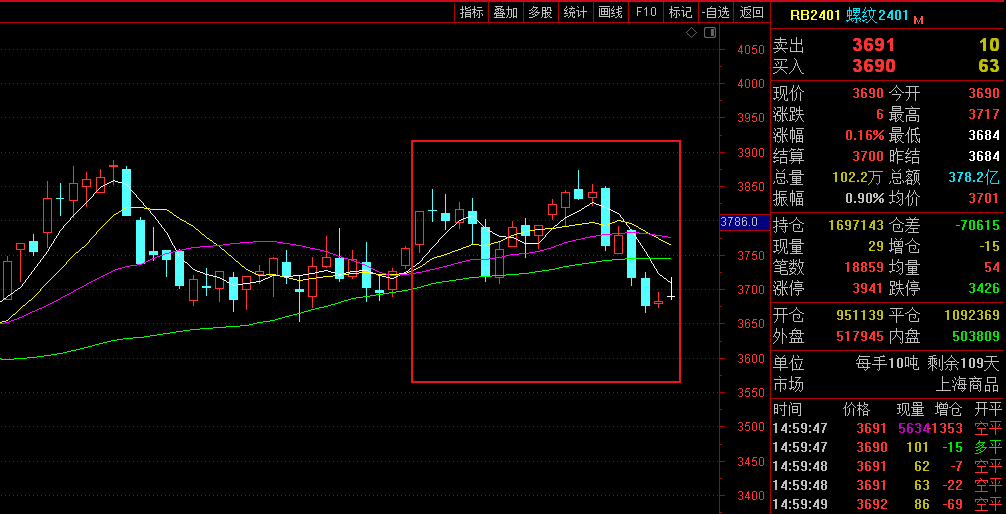

[Steel Market]In early September, with the frequent occurrence of macroeconomic favorable policies, the market rebounded, but in the later stage, the supply-demand contradiction began to emerge and prices slightly declined. The traditional peak season of demand for "Goden September" has not been fulfilled. Due to the high cost of raw materials such as coke, steel mills had weak enthusiasm for increasing production. However, there was currently no clear intention to reduce production, and short-term inventory was difficult to significantly reduce, and steel mills' profits may be further squeezed. But due to the relative rationality of the market, coupled with the continued macro confidence and expectations of a decline in production, the industry was expected to experience a "not weak" trend in the fourth quarter.

[Metal Magnesium Market] In September, the domestic magnesium metal market emerged from a bullish trend of continuous growth: in the first week, driven by downstream procurement follow-up and rising raw material prices, the quotation rapidly increased from around 22800-22900 CNY/T to around 24200-24300 CNY/T; In the second week, there was a slight decline, but with some customers who stocked up before the National Day holiday, prices quickly stopped falling and stabilized, rebounding to around 24500 CNY/T; In the third week, it continued to operate steadily at a high level, with a slight increase in the quotation to around 24600-24700 CNY/T; At the end of the month, as the Mid-Autumn Festival and National Day approaching, the downstream demand decreased, there were not many transactions, and some factories had slightly reduced prices to around 24500-24600 CNY/T. Considering favorable factors such as limited factory stock, continuous decline in inventory, and tight supply, the industry sentiment remained optimistic about the post holiday market trend. Follow up on demand.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think