This week, ferrosilicon futures rose first and then declined, and was overall upgoing. The spot price rose with the support of futures. There were enterprises in Ningxia that offer about 9300 RMB/MT for 72# standard; In June, the tender price of ferrosilicon 75B of HBIS Group was 9600 RMB/MT, a decrease of 900 RMB/MT compared with the previous month, and an increase of 300 RMB/MT compared with the first inquiry price, exceeding the market expectation and the tender volume was 2099 tons, an increase of 683 tons compared with the previous month; Some enterprises in Shenmu region of Shaanxi province raised the price of semi-coke to 1850 RMB/MT (according to Ferro-Alloy.com, the price of small-sized materials this week was mostly about 1750-1800 RMB/MT). At present, the ferrosilicon production end was still stable and relatively high. Driven by relevant regional policies, costs and other factors, ferrosilicon futures and steel tender this week showed a trend of strong shocks, but the actual demand has not been significantly eased, the transaction growth was limited, and the short-term market operation was mostly cautious.

In the downstream, according to the data of China Iron and Steel Association, in late May 2022, key iron and steel enterprises produced 25.5119 million tons of crude steel, with a daily output of 2.3193 million tons, a month on month increase of 0.88%. At the end of late May, the steel inventory was 17.9424 million tons, a decrease of 2.035 million tons or 10.19% compared with the previous ten days; A decrease of 146320 tons, or 0.81%, compared with the same period last month; An increase of 6.6455 million tons over the beginning of the year, an increase of 58.83%; It increased by 4.5286 million tons over the same period last year, an increase of 33.76%; It is 58500 tons more than the highest point of last year (17.8839 million tons in the first ten days of March), an increase of 0.33%. With the acceleration of resumption, the steel demand was expected to recover, and certain institution believed that demand and profit of the steel industry was expected to meet a point of inflection in June.

This week, the domestic metal magnesium market was first depressed and then raised. In the early part of the week, the downstream demand continued to be weak, and the magnesium market continued to fall back to 25000 RMB/MT. In the late part of the week, with the downstream stopped waiting and purchasing, the magnesium Market hit the bottom and rebounded, and the quotation rose to about 26000-27000 RMB/MT. Considering that the price of ferrosilicon has moved up, the price of magnesium was close to the cost line, the willingness of the factory to stabilize the market has increased, due to the downstream has gradually returned to normal since June, and the demand was expected to gradually improve. In the short term, the magnesium market may be in a stable operation situation, and we should pay attention to the demand follow-up.

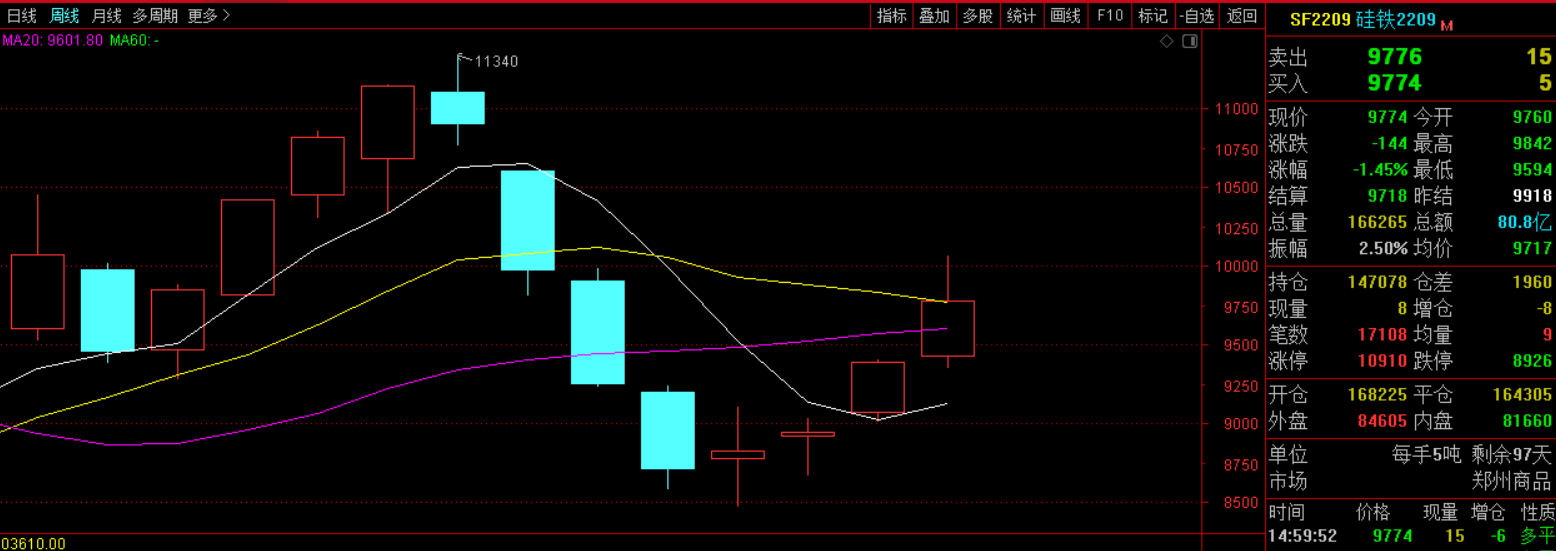

The weekly opening price of 2209 main contract was 9,430, the highest price was 10,068, the lowest price was 9,346, the closing price was 9,774, the settlement price was 9,718, the trading volume was 836,977, and the position was 147,078, up 4.60%.

Below are ferrosilicon futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

6.6 |

9430 |

9484 |

9346 |

9410 |

9418 |

113799 |

123244 |

0.71% |

|

6.7 |

9410 |

9588 |

9372 |

9538 |

9518 |

138472 |

122421 |

1.27% |

|

6.8 |

9580 |

9928 |

9556 |

9902 |

9788 |

203221 |

149535 |

4.03% |

|

6.9 |

9902 |

10068 |

9738 |

9762 |

9918 |

215220 |

145118 |

-0.27% |

|

6.10 |

9760 |

9842 |

9594 |

9774 |

9718 |

166265 |

147078 |

-1.45% |

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think