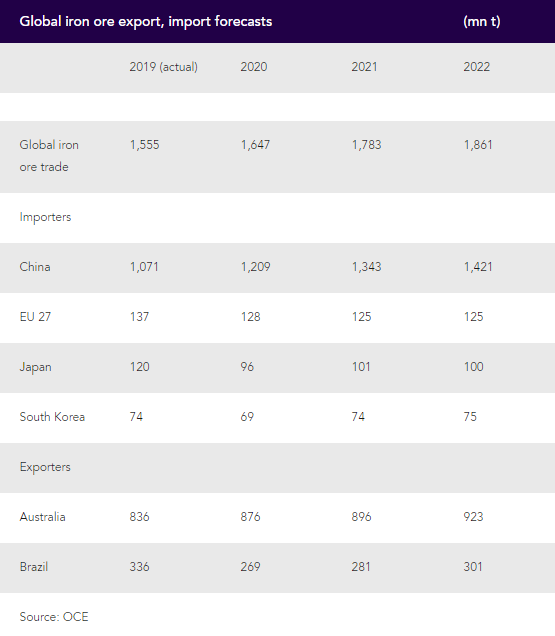

[Ferro-Alloys.com] Australian government commodity forecaster the Office of the Chief Economist (OCE) has raised its forecast for Chinese iron ore demand in 2020 but cut its projection for Brazilian exports by over a quarter.

The OCE has raised its 2020 Chinese demand forecast by 4.5pc to 1.21bn t from its previous projection of 1.16bn t in September, reflecting the impact of government spending on transport infrastructure including rail and road projects.

But it now sees Brazil's iron ore exports at just 269mn t, down by 26pc from its previous forecast of 366mn t, because of mine production problems at the country's largest producer Vale.

Strong Chinese demand and supply disruptions from Brazil have sent iron ore port prices to near record highs.

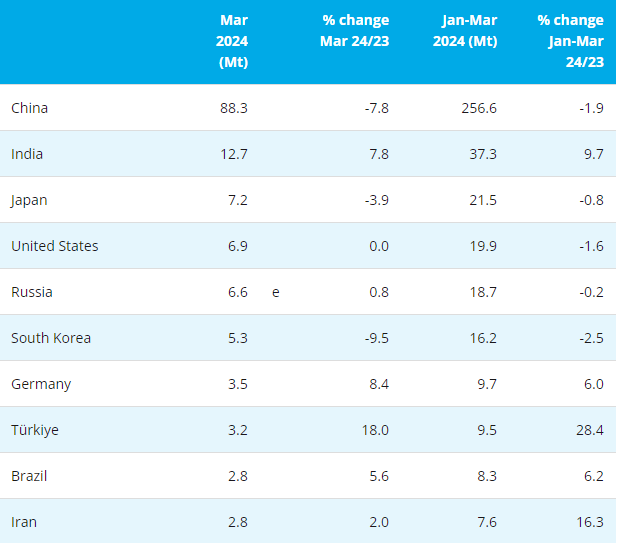

China's iron ore demand is expected to remain high over the next 12 months, although Chinese steelmakers may seek to reduce production slightly should iron ore prices remain at a level that renders many of them unprofitable, the OCE said. Demand in many other countries is expected to stay below its 2019 level, with range of steelmakers in Europe and south Asia remaining on hiatus or shut down and not expected to return to production until iron ore prices drop.

But Chinese iron ore demand growth may be nearing its end. "Chinese demand for iron is likely at its peak, with a decline expected over the next 10 years as a growing share of its steel production is drawn from domestic recycling. This will result in reduced Chinese dependence on the seaborne iron ore market," it said.

Source: Argusmetal

Jan. 15, 2020 Beijing China

----------------------------------Scan QR code for registration---------------------------------

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think