[Raw Material] The ex-factory quotation for small-sized semi coke was about 720-860 CNY/T; The factory price of silica was around 180-260 CNY/T; The price of oxide skin was around 930-960 CNY/T; The electricity prices ranged from 0.41 to 0.52 CNY//kWh.

[Spot Market] Since the end of March, the futures market has continued to rise, boosting industry confidence to a certain extent and showing signs of recovery in the spot market. However, the tender volume and price of HBIS Group have both decreased (in April, the tender price for 75B ferrosilicon was 6600 CNY/T, an increase of 100 CNY/T compared to the inquiry price, a decrease of 150 CNY/T compared to the previous month, and the volume was 1516 tons, a decrease of 124 tons compared to the previous month), causing market sentiment to turn to wait-and-see again. After all, the demand side still needed improvement, downstream procurement enthusiasm was average, and the acceptance of high priced products was low. In a game state, the market remained stagnant and operated steadily. The quotation for 72# ferrosilicon standard blocks was mostly around 6200-6300 CNY/T, while the quotation for 75# ferrosilicon standard blocks was around 6500-6600 CNY/T.

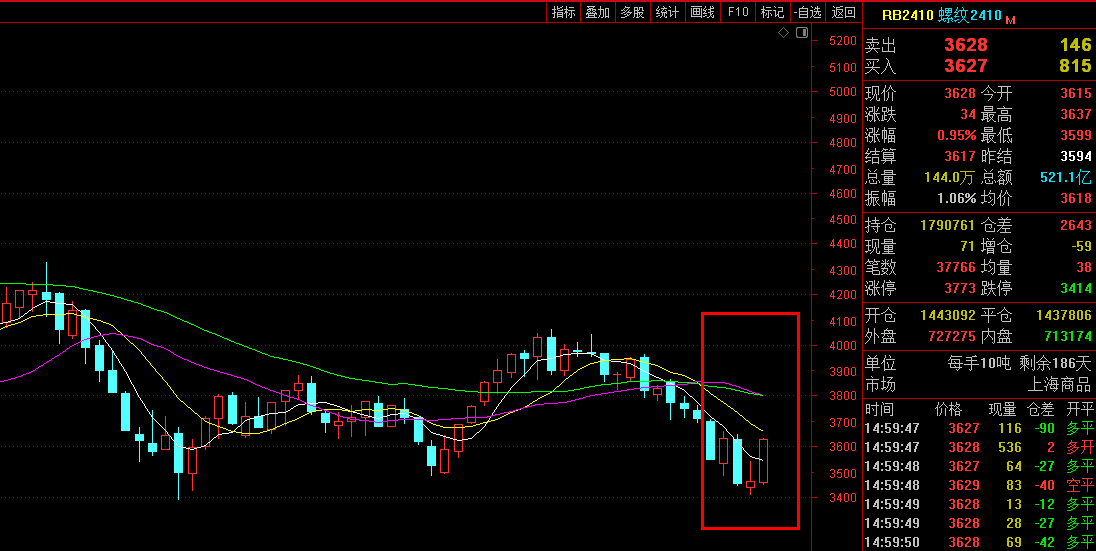

[Futures Market] The opening price of 2405 main contract was 6494, the highest price was 6606, the lowest price was 6474, the closing price was 6590, the settlement price was 6560, the position was 88089, the trading volume was 450633, and the transaction amount was 14.7562 billion yuan, an increase of 1.35%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

3.29 |

6380 |

6410 |

6352 |

6406 |

6376 |

0.53% |

64720 |

188554 |

206338.99 |

|

4.1 |

6398 |

6488 |

6340 |

6482 |

6416 |

1.66% |

138313 |

168719 |

443666.43 |

|

4.2 |

6492 |

6510 |

6450 |

6496 |

6486 |

1.25% |

106248 |

152917 |

344528.75 |

|

4.3 |

6502 |

6528 |

6480 |

6494 |

6502 |

0.12% |

80575 |

141562 |

261938.73 |

|

4.8 |

6494 |

6566 |

6474 |

6542 |

6514 |

0.62% |

90081 |

133005 |

293342.61 |

|

4.9 |

6534 |

6580 |

6500 |

6580 |

6546 |

1.01% |

88463 |

123905 |

289513.82 |

|

4.10 |

6570 |

6600 |

6520 |

6552 |

6556 |

0.09% |

75590 |

116000 |

247766.34 |

|

4.11 |

6532 |

6590 |

6526 |

6568 |

6572 |

0.18% |

92816 |

103009 |

304980.8 |

|

4.12 |

6530 |

6606 |

6510 |

6590 |

6560 |

0.27% |

103683 |

88089 |

340021.36 |

[Demand Market] Starting from April, we have entered the traditional peak season of steel consumption, with a rebound in apparent demand and a decrease in inventory; At present, China's macro policies are still favorable, with continuous growth in manufacturing investment on the demand side, increased construction progress and an increase in steel demand, which may drive prices to a upward trend. The World Steel Association (worldsteel) released its Short Range Outlook (SRO) steel demand forecast for 2024 and 2025 on 9th, April. worldsteel forecasts that this year demand will see a 1.7% rebound to reach 1,793 Mt. Steel demand is forecast to grow by 1.2% in 2025 to reach 1,815 Mt. They expect that steel demand in China in 2024 will remain around the level of 2023, as real estate investments continue to decline, but the corresponding steel demand loss will be offset by growth in steel demand coming from infrastructure investments and manufacturing sectors.

This week, the domestic magnesium market stabilized first and then rose, with a slight consolidation. There is not much pressure to ship for factories, they kept a positive attitude and a strong reluctance to sell; While downstream players were more cautious and cautious, with low acceptance of high prices. The game between the two sides was obvious, and it was expected to continue to maintain stable operation in the short term. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 18300-18400 CNY/T. Continue to focus on demand and transaction status.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think