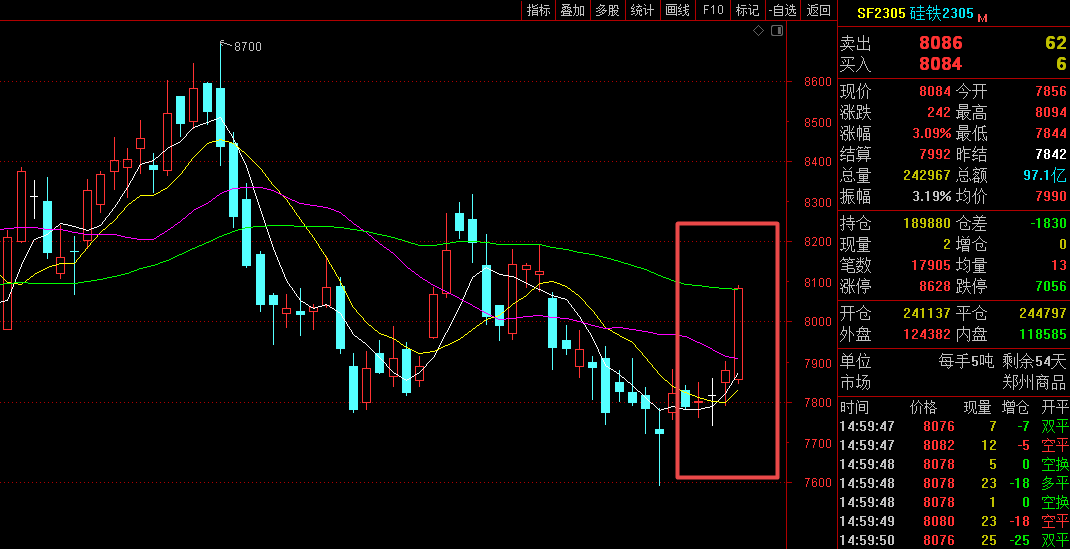

According to market news, from the 25th, the production of semi-coke enterprises in Shenmu, Fugu, Inner Mongolia and some other places would be reduced to less than 35%, and the minimum guiding price of 1300 CNY/T to be implemented for small-sized materials. The actual implementation and impact of the follow-up needs to be follow. This week, the market of ferrosilicon Futures fluctuated and rose sharply, with the opening price of the 2305 main contract being 7,830, and the highest price 8,094, the lowest price 7,740, the closing price 8,084, the settlement price 7,992, the trading volume being 826,737, the position being 189,880, up 3.30%. The spot market maintained a weak and stable operation trend, and the downstream demand release was slow (the northern steel tender price has dropped to 7850 CNY/T, and the export volume of ferrosilicon (containing by weight more than 55% of silicon) in January-February decreased by 36868.663 tons year-on-year, a decrease of 32.70%; The metal magnesium market also continued to be sluggish); The profits of manufacturers have shrunk, and the more and more enterprises started regular servicing and production reducing and mainly focused on consuming inventory, with a cautious wait-and-see attitude. Pay attention to the performance of the steel tender in April.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

3.20 |

7830 |

7842 |

7780 |

7786 |

7810 |

124032 |

200571 |

-0.51% |

|

3.21 |

7800 |

7852 |

7760 |

7802 |

7810 |

132613 |

194347 |

-0.10% |

|

3.22 |

7816 |

7858 |

7740 |

7816 |

7792 |

151366 |

198664 |

0.08% |

|

3.23 |

7850 |

7904 |

7788 |

7878 |

7842 |

175759 |

191710 |

1.10% |

|

3.24 |

7856 |

8094 |

7844 |

8084 |

7992 |

242967 |

189880 |

3.09% |

Downstream, according to data of CISA, in mid-March, the daily average output of crude steel in key steel enterprises was 2.2531 million tons, up 4.71% than the last ten days and 9.9% year-on-year; The steel inventory of key enterprises was 18.9574 million tons, an increase of 1.2533 million tons or 7.08% over the ten-day period. This week, the Futures market fell down, driving the weak operation of the spot market, the transactions were light and sentiment was weaker. In January-February, the national steel export volume was 12.19 million tons, a year-on-year increase of 49%. The industry predicted that the export would be strong or continue until May, but there are still many uncertain factors in the external environment and the market mentality was relatively cautious.

The domestic demand was weak, and the export volume of magnesium ingots declined in January and February. Under the market pattern of oversupply, the domestic metal magnesium market continued to be sluggish this week, with prices falling below 20000 CNY/T. On Thursday and Friday, the market stopped declining and maintained stable. The mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was about 19900-20000 CNY/T. Given that the current magnesium price has fallen to the factory cost line, and in some regions the selling price lagged behind the costs, some manufacturers began to plan reducing production. Without positive support for the time being, the short-term magnesium market would still be dominated by weak operation. Pay attention to the progress of changes in both supply and demand.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think