【Ferro-alloys.com】:Brazil is expected to see a drop in both exports and imports next year due to the weakness of the global economy.

The country's exports are expected to reach US$325bn in 2023, down 2.3% compared with 2022, while imports are forecast to fall 6.2% to US$253bn, according to Brazil’s export association AEB.

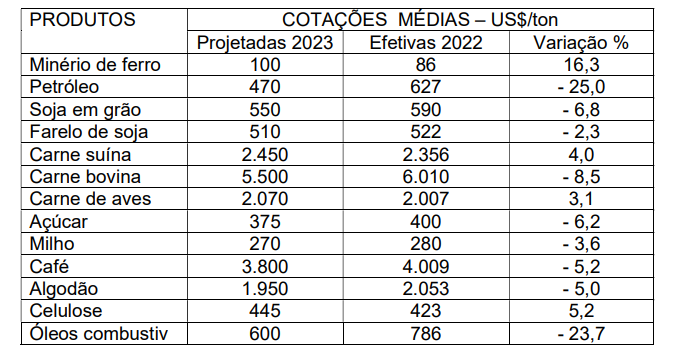

"One of the reasons is the expected reduction in commodity prices, which remained high in 2022, amid the challenging scenario of the world economy," José Augusto de Castro, president of AEB, tells BNamericas.

AEB projects the country's trade surplus will likely reach US$71.9bn in 2023, compared with US$62.9bn this year.

In this interview, Castro talks about the outlook for Brazil’s foreign trade in the next year and also what he considers should be the priority of incoming president Luiz Inácio Lula da Silva to promote trade.

BNamericas: Despite the higher trade surplus expected for next year, AEB projects a drop in both exports and imports. What explains this?

Castro: Basically, this will happen because of the drop in the price of commodities that Brazil exports. In 2022 we’ve seen the price drop of some commodities and next year this will tend to continue.

I would draw attention mainly to the drop in the price of oil. In addition to this effect, we’ll have an impact on exports in the automobile sector, since the Argentine economy, which is the main buyer of vehicles and spare parts from Brazil, will continue to face difficulties.

In the case of imports, the drop will be due to the downturn in the domestic economy projected for next year.

BNamericas: What explains the drop in the price of some of the commodities you mention, like oil?

Castro: We already see signs of a slowdown in global economic growth. China's economy is weakening, in the US and Europe the continuation of the policy of increasing interest rates is impacting economic activity in these regions.

In general, the scenario faced by Brazil's foreign trade next year is the same as the rest of the world, which points to a reduction in global trade activity.

BNamericas: Even with the cloudy scenario, AEB projects an increase in the price of iron ore for next year. Why?

Castro: In fact, iron ore is a surprise. For many months we saw iron ore prices under pressure, but in more recent months we’ve seen a recovery and this should result in 2023 in average iron ore prices higher than in 2022.

But the big question will be how far will the iron ore trend continue, since China's economic performance is still unclear.

BNamericas: China is Brazil's main trading partner. What is the expectation of China's economic performance next year?

Castro: The Chinese economic performance is still a major uncertainty. We’re already seeing a slowdown in the Chinese economy and at the same time we see that the COVID-19 pandemic is spreading there.

I wouldn't be surprised if China’s performance is worse than analysts have estimated for next year and that would be quite bad for Brazil, since they’re the big buyers of our commodities.

BNamericas: What do you expect will be the impact of the new government on Brazil’s foreign trade?

Castro: Foreign relations in Brazil, both with President Lula and with minister Mauro Vieira, who has already been appointed to the post, are in good hands.

But it’s not enough for Brazil just to open new markets for trade. We have to conquer markets and to conquer markets we have to be competitive in terms of prices.

BNamericas: How can the country become more competitive?

Castro: The elected government has to work on advancing the tax reform, to reduce costs and bureaucracy for companies.

Specifically with regard to foreign trade, we need to end the tax model that generates tax credits for companies, when in fact companies never manage to transform this credit into cash and over time it becomes more costs.

A well-executed tax reform will be key to making Brazil more competitive in the foreign market and exporting more high value-added products and not just commodities.

- [Editor:Alakay]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think