|

Commodity |

Steel Mills |

Price (RMB/T) |

Change vs. Last Month (RMB/T) |

Volume & change vs. last month (Tons) |

|

FeSi75-B |

ZENITH |

9200 |

-1300 |

1300 tons (-1200 tons) |

|

FeSi75-B |

KISC |

/ |

/ |

FeSi72Al1.5 1300 tons |

|

FeSi75-B |

Xiangtan Iron & Steel |

9300 |

-1000 |

1200 tons (-700 tons) |

|

FeSi75-B |

Nanjing Iron and Steel |

9200 |

/ |

1000 tons |

|

FeSi75-B |

KISC |

9290/9360 |

|

FeSi72Al1.5 1000 tons |

|

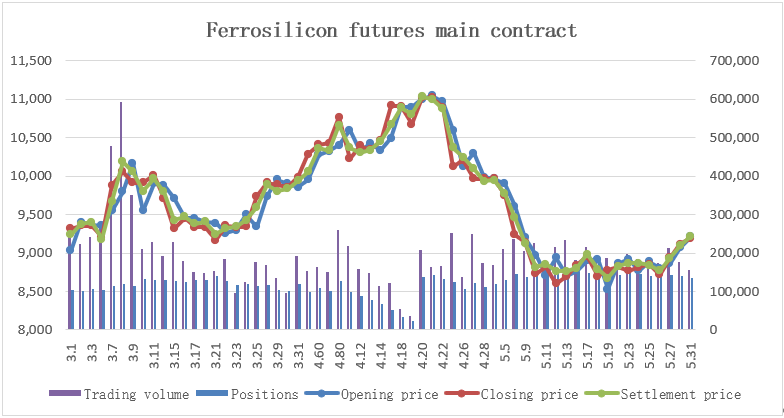

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

5.5 |

9904 |

9984 |

9616 |

9750 |

9770 |

209993 |

130584 |

-1.99% |

|

5.6 |

9608 |

9610 |

9224 |

9240 |

9460 |

236874 |

146596 |

-5.42% |

|

5.9 |

9200 |

9238 |

9018 |

9144 |

9126 |

206102 |

138883 |

-3.34% |

|

5.10 |

8970 |

8970 |

8680 |

8730 |

8814 |

226033 |

140601 |

-4.34% |

|

5.11 |

8712 |

8980 |

8710 |

8820 |

8858 |

176326 |

142035 |

0.07% |

|

5.12 |

8940 |

8982 |

8580 |

8604 |

8764 |

216241 |

152909 |

-2.87% |

|

5.13 |

8700 |

8884 |

8656 |

8700 |

8764 |

232918 |

156512 |

-0.73% |

|

5.16 |

8772 |

8866 |

8740 |

8842 |

8806 |

181005 |

151041 |

0.89% |

|

5.17 |

8898 |

9112 |

8858 |

8962 |

8988 |

215027 |

149569 |

1.77% |

|

5.18 |

8922 |

8922 |

8682 |

8698 |

8792 |

175855 |

154782 |

-3.23% |

|

5.19 |

8530 |

8794 |

8462 |

8776 |

8670 |

187205 |

158499 |

-0.18% |

|

5.20 |

8860 |

8900 |

8766 |

8820 |

8832 |

163007 |

144294 |

1.73% |

|

5.23 |

8920 |

8980 |

8740 |

8772 |

8868 |

198568 |

156074 |

-0.68% |

|

5.24 |

8772 |

8992 |

8772 |

8816 |

8870 |

183816 |

144523 |

-0.59% |

|

5.25 |

8886 |

8936 |

8710 |

8852 |

8842 |

168445 |

141601 |

-0.20% |

|

5.26 |

8800 |

8892 |

8666 |

8718 |

8772 |

175263 |

151621 |

-1.40% |

|

5.27 |

8860 |

9034 |

8840 |

8940 |

8934 |

213774 |

142263 |

1.92% |

|

5.30 |

9070 |

9176 |

9002 |

9118 |

9096 |

177888 |

140881 |

2.06% |

|

5.31 |

9210 |

9288 |

9156 |

9196 |

9222 |

155793 |

135622 |

1.10% |

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think