On April 19, the National Development and Reform Commission announced that the national crude steel output reduction would be continued in 2022 to promote the high-quality development of the iron and steel industry.

This week, ferrosilicon futures consolidated at a high level and fluctuated in a narrow range. The spot market was strong and maintained stable operation. The turnover followed the rise, the export performance was good, and the demand of downstream steel mills was expected to release, so it was difficult to find low-cost goods; Producters had high production enthusiasm, and the supply side remained stable as a whole. Many manufacturers said that they have no spot and arrange orders for production. The market sentiment was optimistic and cautious, and the wait-and-see atmosphere was relatively strong. It was expected that the short-term ferrosilicon market would continue to operate steadily. Pay attention to the performance of the new round of steel tender volume and price and the trend of futures.

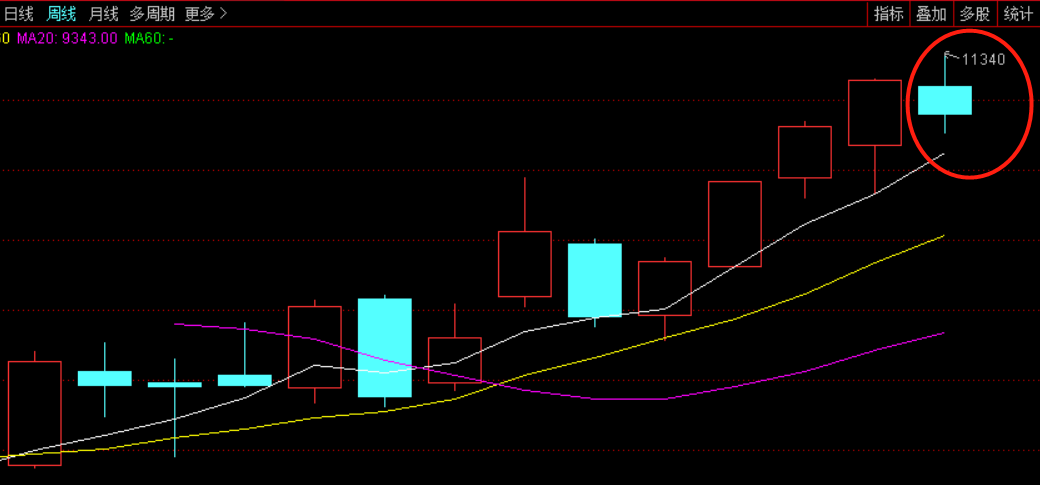

The weekly opening price of 2209 main contract was 11,102, the highest price was 11,340, the lowest price was 10,758, the closing price was 10,894, the settlement price was 10,880, the trading volume was 1,147,908, and the position was 133,397, a decrease of 0.18%.

Below are ferrosilicon futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

4.18 |

10900 |

11062 |

10696 |

10908 |

10892 |

54958 |

34935 |

2.21% |

|

4.19 |

10900 |

11002 |

10568 |

10674 |

10806 |

37397 |

23920 |

-0.64% |

|

4.20 |

11000 |

11186 |

10910 |

11018 |

11036 |

207632 |

139151 |

-0.02% |

|

4.21 |

11050 |

11112 |

10900 |

11018 |

11002 |

164748 |

144045 |

-0.16% |

|

4.22 |

10972 |

10996 |

10758 |

10894 |

10880 |

166601 |

133397 |

-0.98% |

In terms of downstream steel markets, considering that many places were still implementing control management, the growth rate of crude steel output was relatively slow; Due to the current high prices of raw materials such as iron ore and coke, and the weak demand of downstream construction projects and manufacturing industry, iron and steel enterprises were under great pressure. The National Development and Reform Commission and other relevant departments released information that in 2022, the national crude steel output would continue to be reduced, which may restrain the demand for raw materials, promote the return of costs to rationality, improve the profitability of iron and steel enterprises and market expectations, and boost market confidence. The short-term steel price was still supported and may continue to fluctuate at a high level.

This week, the domestic metal magnesium market first decreased and then increased, with stable and strong operation. The confidence of the supply side was boosted and the willingness to support the price was strengthened. And downstream users successively followed up the inquiry and purchase, and the demand was also released to a certain extent. However, the overall downstream demand was still weak, and the probability of a sharp rise in magnesium prices may not be too great. It was expected that the market would remain stable in the short term. On Friday, the ex-factory cash quotation including tax of 99.9% magnesium ingots was about 37000-38000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think