After the National Day holiday, power rationing and production curbs in the main production areas eased to somewhat compared with that before the holiday, but it was still severe. The rise of electricity price was a conclusion, with slight differences among different regions. Since the middle of October, the futures almost fallen sharply, with obvious shocks and several limit drops; The decline in the spot market was relatively flat, but the quotation has been reduced by more than 3000 yuan per ton from the peak.

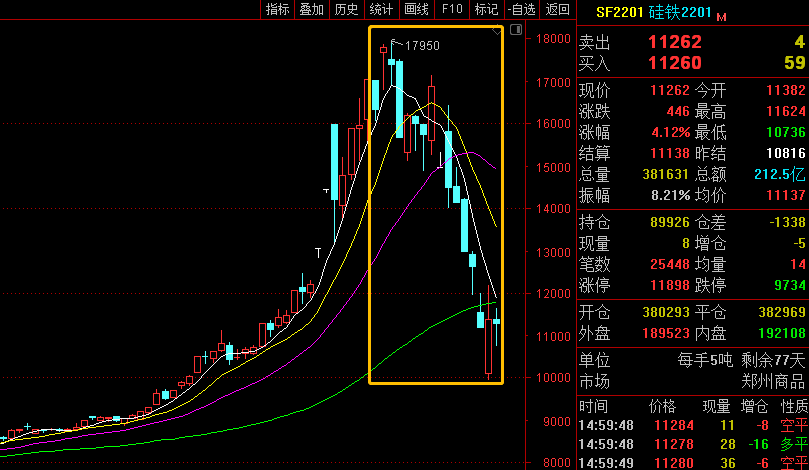

Due to tight power supply, rising electricity price, high raw material price and blocked transportation in some areas, many ferrosilicon plants said that the production cost was high and there were some difficulties in production and delivery. Since October 28, several ferrosilicon plants in Zhongwei area of Ningxia issued power-cut applications for submerged arc furnaces, and the futures market immediately stopped falling and rebounded in the afternoon. The opening price of 2201 main contract of ferrosilicon futures in October was 17000, the highest price was 17950, the lowest price was 9930, the closing price was 11262, the settlement price was 11138, the trading volume was 5710500, and the position was 89926, an decrease of 30.24%.

Currently, ferrosilicon manufacturers generally reduced production, the inventory was little, and the market was expected still to be in a tight balance in the short term, but it’s also necessary to consider the progress of downstream demand, because the ferrosilicon transactions were not well enough recently, the new round of bidding for steel mills was delayed, and overseas demand also decreased (according to data of China Customs, in September 2021, China exported 32582.57 tons of ferrosilicon (containing by weight more than 55% of silicon), with a month on month decrease of 52.66%). Although the futures rebounded, there was not expected much room to rise. Although the market sentiment has changed, it was still weak. Wait for the mainstream steel bidding price, and pay attention to the changes of raw material cost, operation rates and supply-demand relationship.

In terms of steel market, under the influence of multiple factors such as energy consumption control and production curbs in heating season, Tangshan, Handan, Zibo, Anyang and some other places started to control the steel mills operation; In the fourth quarter, the downstream demand was lower than expected, both the supply and demand of the steel market were weak. In the first three quarters of this year, the domestic crude steel output increased by about 16 million tons compared with the same period last year, which still lagged behind the output decline target set by the Ministry of Industry and Information Technology for the iron and steel industry. Wang Yingsheng, chief economist of China Iron & Steel Association, said that under the condition that the annual crude steel output did not increase, the crude steel output needed to be further reduced in the fourth quarter. It was roughly estimated that the crude steel output would be reduced by 18.33 million tons from November 15, 2021 to December 31, 2021.

"There is no market that only rises but not falls, and there is no market that only falls but not rises". Affected by the weak downstream demand, the overall recovery of the supply side, changes in the relationship between supply and demand, as well as the weak raw material ferrosilicon and coal market, the domestic metal magnesium market weakened in October, the quotation continued to decline, the majority of people continued to wait and see, and some factories had no choice but to sell at a low price, the market was not optimistic. Whether the market can stop falling and stabilize depends on the follow-up of subsequent transactions. On Friday, October 29th, the ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was down to about 36000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think