[Bidding Information] The steel bidding in April was delayed, and the price dropped significantly, which promoted the spot market running weakly.

[Spot Market] In the early part of this week, despite the news of overhauling of large factories and suspension of mines, the impact on ferrosilicon spot market has not yet been obvious; there were not many real positive factors in the spot market, and there were 33000kva / 40500kva furnaces in Ningxia put into production, the supply side continued to be stable, and the inventory gradually accumulated, but the actual transaction was not too many, the factory's confidence was weak, and wait-and-see mood continued. On the demand side, the strict implementation of the production restriction policy has more or less affected the demand for ferrosilicon. However, due to the cost support, some manufacturers believed that there was not a great chance that the mainstream quotation of ferrosilicon lower than 6400-6500 yuan per ton.

Starting from this Thursday (April 15), the main futures contracts rose sharply, boosting the spot market, increasing the activity of inquiry and stabilizing the price. It is expected that the ferrosilicon market to be consolidated in the short term.

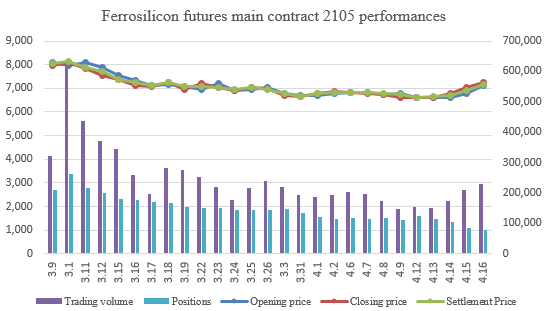

[Ferrosilicon Futures 2105 Contract] Opening price of ferrosilicon futures 2105 contract of this week was 6,620, highest price was 7,328, lowest price was 6,540, closing price was 7,258 and the settlement price was 7,144. The trading volumes were 917,041 and the positions were 77,789.

[Steel Market] In the first quarter of 2021, China's crude steel output was 271 million tons, an increase of 15.6% year-on-year (data from the National Bureau of Statistics); in the first quarter, China exported 17.68 million tons of steel, up 23.8% year on year (data of China Customs).

In this week, due to the relatively high steel price, downstream orders were not as many as expected, combined with the rising cost pressure, the strict environmental protection and production restriction policies, steel plants were lack of power to increase production, but the downstream consumption has declined, and the decline in inventory has slowed down slightly.

[Magnesium Market] This week, the domestic magnesium market was stable and then rose - the transaction was generic in the early part of the week, and the market began to be active on Thursday. In addition, the factories were not under much inventory pressure, and the price of raw coal was in a high position, the price of magnesium was expected to be strong. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 15600-15700 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think