[Top News] Recently,Inner Mongolia Development and Reform Commission said they will "balance the gap of energy consumption in the fourteenth five year plan", and strictly control the access of high energy consuming industries. From 2021, projects such as ferroalloys, and semi-coke and some others will no longer be approved, and new coal chemical projects will not be approved in principle. In addition, according to market news, power rationing may be implemented in Inner Mongolia, and relevant personnel said that the electricity price in Inner Mongolia will rise by three points, and multilateral trading will be cancelled, which is expected to be officially implemented next month. The electricity price rises by 3 points, and it is predicted that the cost of ferrosilicon production will increase by 250 yuan per ton.

[Steel Bidding] Ferrosilicon bidding in January, 2021 comes to the end, and the average price is about 7200-7300 yuan per ton, an increase of about 700 yuan per ton compared with the previous month.

[Spot Market] This week, the domestic ferrosilicon market is generally stable and strong. Although the operating rate and output have increased under the influence of the implementation of Ningxia electricity price reduction and the weakening impact of environmental protection and production restriction, and the downstream magnesium market has rapidly weakened, most manufacturers are still tight in spot. Shenmu semi-coke small size rose to about 1150 yuan per ton. In cold weather, the freight charges also have gone up with varying degrees. In addition to the influence of energy consumption control policy and electricity price increase policy in Inner Mongolia, the ferrosilicon futures rose sharply, driving the overall optimism of ferrosilicon spot market and strong bullish sentiment in the market.

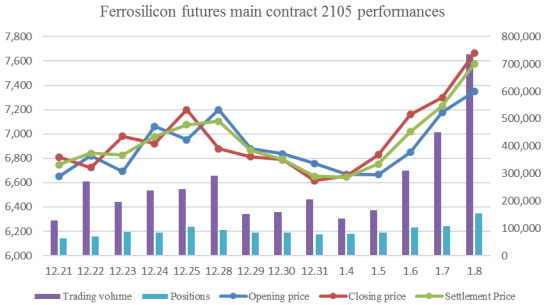

[Ferrosilicon Futures 2101 Contract] Opening price of ferrosilicon futures 2105 contract of this week was 6,670, highest price was7,664, lowest price was 6,572, closing price was 7,664 and the settlement price was 7,576. The trading volumes were 1,799,200 and the positions were 154,420.

[Steel Market] As the Spring Festival is approaching, the replenishment willing of steel mills is high, and it is expected that most of the stock will be replenished in the middle and late January. Due to the limited construction schedule in winter, the demand for construction steel in the north is less than that in the south. With the high price of rebar, the traders are not much desired in winter storage. The inventory of steel plants increased month on month in December, and there may be further accumulation after January. It is expected that the steel price will be weak and volatile before the Spring Festival.

[Metal Magnesium Market] High cost of raw materials supports the price of magnesium, but the poor downstream demand makes the manufacturers have to make a substantial price reduction. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 14200 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think