[Raw Material] The ex-factory quotation for small-sized semi coke was about 1000-1050 CNY/T; The factory price of silica was around 180-250 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The electricity prices ranged from 0.38 to 0.50 CNY//kWh.

[Spot Market] This week, the ferrosilicon futures market continued to fluctuate at a low level, leading to a lack of confidence in the spot market, cautious operations, and lackluster trading performance; Although some companies on the supply side had slightly implemented plans to reduce production, the overall situation remained stable. Manufacturers had a strong attitude towards shipping, and some lowered their prices by 50-100 CNY/T due to inventory and year-end financial pressure. This week, the quotation for 72# ferrosilicon standard blocks was mostly around 6450-6550 CNY/T, while the quotation for 75# ferrosilicon standard blocks was around 7100-7200 CNY/T. Analysis suggested that the market was unlikely to improve before the Chinese New Year.

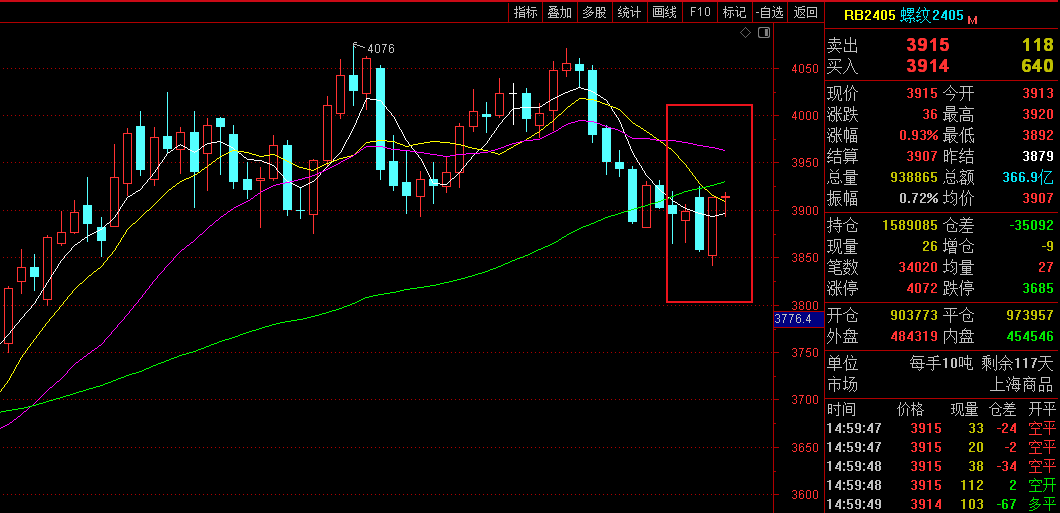

[Futures Market] The opening price of 2403 main contract was 6700, the highest price was 6754, the lowest price was 6626, the closing price was 6674, the settlement price was 6684, the position was 218587, the trading volume was 578040, and the transaction amount was 19.3324 billion yuan, a decrease of 0.60%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

1.15 |

6700 |

6736 |

6668 |

6694 |

6708 |

-0.30% |

109611 |

254338 |

367604.23 |

|

1.16 |

6698 |

6704 |

6658 |

6702 |

6682 |

-0.09% |

109644 |

241259 |

366308.21 |

|

1.17 |

6728 |

6754 |

6638 |

6646 |

6698 |

-0.54% |

164876 |

241303 |

552133.45 |

|

1.18 |

6650 |

6702 |

6626 |

6690 |

6668 |

-0.12% |

102388 |

228729 |

341311.02 |

|

1.19 |

6668 |

6710 |

6660 |

6674 |

6684 |

0.09% |

91521 |

218587 |

305880.28 |

[Demand Market] According to data from the National Bureau of Statistics, in December 2023, China's crude steel production reached 67.44 million tons, a year-on-year decrease of 14.9%; From January to December, China's crude steel production reached 1019.08 million tons, flat year-on-year. As the Chinese New Year approached, the steel market was gradually becoming cheerless and demand was weakening. The trading atmosphere was cautious, and inventory started to accumulate seasonally. Some steel mills were gradually starting to stop production or reduce production. Although the economy was improving and macroeconomic news was boosting, the weak situation of supply and demand has not changed in the short term. With the deepening of the off-season and low market expectations, coupled with cost support moving downwards, steel prices may continue to fluctuate weakly within a narrow range.

This week, the activity of the magnesium metal market increased after continuous weakness, with prices increasing by 300-400 CNY/T. The factory had a strong willingness to raise prices due to cost support, but downstream demand was still weak, high price acceptance was low, transactions were slowing down, and the game between supply and demand was still present. In the short term, the price was hard to continue increasing, but it was also difficult to fall back, and stability would be the main focus. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 20400-20500 CNY/T.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think