[Raw Material] The semi coke market continued to strengthen, and the quotation for small-sized has been increased to 1180 CNY/T. The ex-factory price of silica was around 200-250 CNY/T, the oxide skin was around 980-1010 CNY/T, and the electrode paste price was around 5000 CNY/T. It was understood that the settlement price of electricity in Ningxia in August was around 0.47-0.5 CNY//kWh. The current cost side support was still relatively strong.

[Spot Market] This week, the ferrosilicon market continued to operate relatively strongly, with quotes for 72# ferrosilicon standard blocks in the main production areas mostly around 7000 CNY/T, and quotes for 75# ferrosilicon standard blocks around 7300-7400 CNY/T. Fujian Sangang Group's September ferrosilicon 75B tender price was set at 7500 CNY/T, with a quantity of 1800 tons. Steel mills was expected to restock before the National Day holiday. Under the restoration of profits, there were still expectations for production growth. It was reported that a large factory in Wuhai, Inner Mongolia has already put the second 45000KVA ferrosilicon furnace into production. The arrival of the traditional peak season and the effective implementation of relevant policies had brought some confidence to the market, believing that future demand may continue to operate at relatively high levels.

[Futures Market] This week, the futures market fluctuated and declined. The opening price of 2311 main contracts was 7318, with a maximum price of 7432 and a minimum price of 7164. The closing price was 7192, the settlement price was 7232, the trading volume was 1105463, and the position was 428495, a decrease of 1.26%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

9.4 |

7318 |

7432 |

7302 |

7328 |

7358 |

293751 |

435953 |

0.69% |

|

9.5 |

7334 |

7356 |

7260 |

7284 |

7314 |

188007 |

444179 |

-1.01% |

|

9.6 |

7320 |

7344 |

7282 |

7330 |

7318 |

163616 |

445144 |

0.22% |

|

9.7 |

7330 |

7394 |

7230 |

7300 |

7308 |

258735 |

437627 |

-0.25% |

|

9.8 |

7296 |

7306 |

7164 |

7192 |

7232 |

201354 |

428495 |

-1.61% |

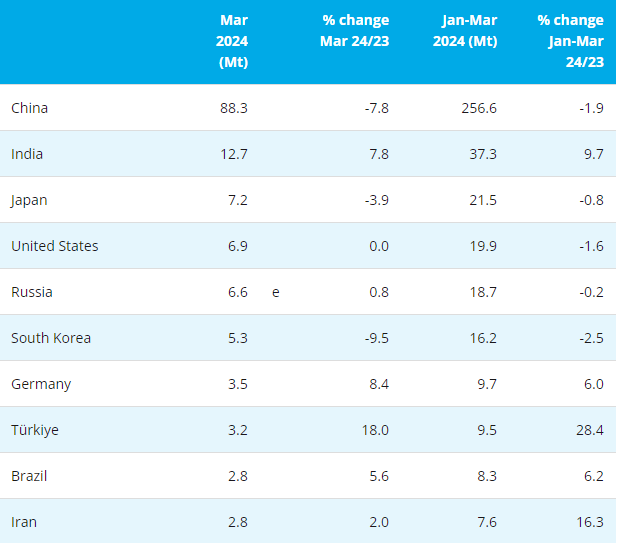

[Demand Market] According to statistics from the China Iron and Steel Industry Association, in late August 2023, the key steel enterprises produced a total of 22.5019 million tons of crude steel, with a daily output of 2.0456 million tons, a decrease of 7.65% compared to the previous period. In late August, the inventory of key steel enterprises was 14.7245 million tons, a decrease of 1.9057 million tons or 11.46% compared to mid August; A decrease of 1.2185 million tons or 7.64% compared to the same period last year. In late August, the social inventory of 5 major varieties of steel in 21 cities reached 9.62 million tons, a decrease of 10000 tons or 0.1% compared to the previous month; An increase of 430000 tons or 4.7% compared to the same period last year. Ansteel Group recently stated that the profits of the steel industry in the second half of the year would still be at a relatively low level. However, under policy regulations such as energy consumption and environmental protection, steel production may decline. It was expected that the overall supply and demand will maintain a weak balance, and steel prices were expected to rebound from the first half of the year. However, the downward trend of global economic fluctuations has not changed and the impact of industrial chain fluctuations may cause overall market development to be volatile.

This week, driven by positive factors such as downstream procurement follow-up and rising raw material prices, the domestic magnesium metal market has once again risen strongly - Monday's quotation was around 22800-22900 CNY/T; Tuesday's quotation was around 22900-23000 CNY/T; On Wednesday, it quickly climbed to 23500 CNY/T; On Thursday, prices continued to rise, ranging from 24000 to 24500 CNY/T; On Friday, as procurement slowed down, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 24200-24300 CNY/T. In the favorable environment of limited factory stock, continuous decline in inventory, and tight supply, it was expected that the magnesium market would be strongly adjusted in the short term.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think