[Spot Market] At the beginning of August, driven by the release of energy consumption control related news in Inner Mongolia and Ningxia, the futures market rapidly rose, and some manufacturers briefly stopped quoting externally, but quickly regained rationality; In mid August, the futures fell and rebounded in late August. The monthly opening price of the 2310 main contract was 7052, the highest price was 7310, the lowest price was 6772, the closing price was 7074, the settlement price was 7040, the trading volume was 5232578, and the position was 137164, an increase of 1.23%. The cost end was relatively strong, with the quotation for small-sized semi-coke at the end of the month slightly increased to around 1020-1060 CNY/T; The factory price of silica was around 200-250 CNY/T; Oxidized skin was around 1000-1030 CNY/T; Electrode paste was around 5400 CNY/T, with support. The production situation of manufacturers was stable, with good order scheduling, low spot resources, and a strong mentality of price support. Enterprises in the production areas have resumed production or put into production to increase production capacity, and it was expected that the production would slightly increase in August compared to the previous month. However, the inventory of the delivery warehouse was still at a high level, with obvious characteristics in the off-season downstream. The export situation has not significantly improved, and the basic contradiction between supply and demand still existed. The game between the two sides was strong, and there is insufficient confidence in a significant increase in ferrosilicon prices. At the same time, the market for magnesium metal has risen, providing support for the price of 75# ferrosilicon. At the end of the month, the quotation for 72# ferrosilicon standard blocks in the main production areas was mostly around 6900-7000 CNY/T, while the quotation for 75# ferrosilicon standard blocks was mostly around 7300-7400 CNY/T.

[Export Data] According to data of China Customs, in July 2023, China exported 24898.292 tons of ferrosilicon (containing by weight more than 55% of silicon), a year-on-year decrease of 32812.206 tons, a decrease of 56.86%; The month on month decrease was 5366.037 tons, a decrease of 17.73%. From January to July 2023, China exported 242038.341 tons of ferrosilicon (containing by weight more than 55% of silicon), a year-on-year decrease of 200259.359 tons, a decrease of 45.28%.

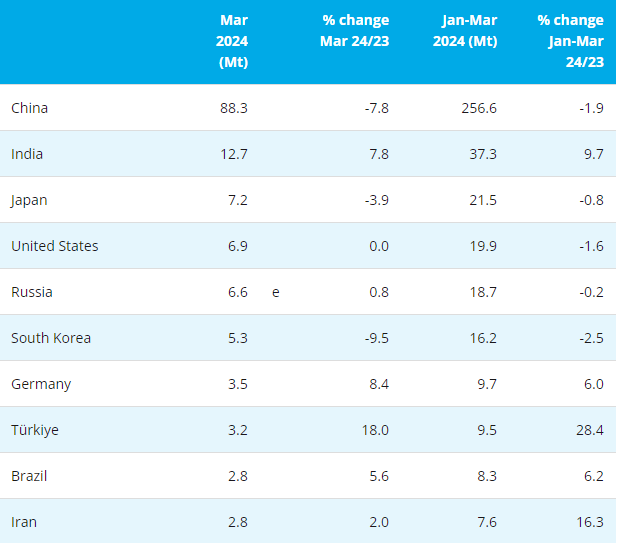

[Steel Market] Seven departments have jointly issued the "Work Plan for Stable Growth in the Steel Industry", proposing to maintain a dynamic balance between supply and demand in the steel industry by 2023; At the same time, it was proposed to implement the action of upgrading steel consumption and focus on expanding steel demand. In the traditional off-season of August, the demand released slowly, the trading atmosphere was relatively weak, inventory accumulated, steel prices were weak, steel mills had poor profits, and even there was a profit to loss. The futures market was declining, the market mentality was turning worse. The cautious wait-and-see mentality was strong. However, the market still had expectations for the future and believed that there was still room for relevant policies to take effect.

[Metal Magnesium Market] At the beginning of August, due to insufficient demand follow-up, magnesium prices slightly weakened, but as transactions increased, they quickly stopped falling and rebounded. During this period, there was a brief period of volatility and consolidation, with magnesium prices exceeding 22000 CNY/T around the middle of the month. In a favorable environment of further contraction in the supply side, difficulty in achieving significant growth in the short term, and no inventory pressure from factories, market confidence was good and there was strong sentiment of price support. In late August, there was an increase in centralized replenishment, and magnesium prices rose again, reaching to 23000 CNY/T! But after all, there was insufficient demand support, and downstream acceptance of high prices has always been limited. Subsequently, the quotation was slightly adjusted to around 22500 CNY/T under pressure. At the end of the month, as demand followed up, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 22800-22900 CNY/T. The traditional peak season has arrived, and the market was mostly optimistic about the future market. Follow up on demand.

Domestic Steel Mills Tender Prices – September, 2023

|

Commodity |

Steel Mills |

Price (RMB/T) |

Month on Month (RMB/T) |

Volume (Tons) |

|

FeSi75-B (72#) |

HBIS Group |

/ |

/ |

2516 tons |

|

FeSi75-B (72#) |

Baowu Steel Group |

/ |

/ |

FeSi75Al1.5-B 2000 tons |

|

FeSi75-B (72#) |

A special steel mill in Hebei |

7160 |

+30 |

1200 tons |

|

FeSi75-B (72#) |

Jinshenglan Group |

To Hubei 7100 |

-150 |

1100 tons |

|

FeSi75-B (72#) |

To Guangdong 7250 |

-180 |

||

|

FeSi75-B (72#) |

Minyuan Steel Group |

7150 |

- |

1000 tons |

|

FeSi75-B (72#) |

KISC |

7500 |

/ |

FeSi72Al1.5 1000 tons |

|

FeSi75-B (72#) |

Chongqing Iron & Steel |

/ |

/ |

FeSi72Al2.0 (10-50mm) 800 tons |

|

FeSi75-B (72#) |

Yunnan Chenggang Group |

7260 |

+40 |

600 tons |

|

FeSi75-B (72#) |

Xusteel Group |

/ |

/ |

(10-50mm, ≥90.0%) 600 tons |

|

FeSi75-B (72#) |

Yangchun New Steel |

7350 |

/ |

400 tons |

|

FeSi75-A (75#) |

Baowu Steel Group |

/ |

/ |

75# (10-50mm) 450 tons |

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think