Recent declines in European and Asian steel prices are not likely to derail a modest market recovery over the past five months, but instead these prices are expected to rise to narrow the gap with higher U.S. levels.

Leading steelmakers, after posting forecast-beating quarterly results, have become more optimistic on the outlook for the $500 billion-a-year industry, which is often seen as gauge of economic health.

ArcelorMittal said its two-year slump was over and that prospects for 2014 were looking up. Tata Steel flagged rising prices in its results and said performance in Europe had improved, though challenges remained.

Meanwhile, however, prices of EU and Asian steel have retreated from three-month peaks reached in September, while. U.S. prices are currently near one-year highs.

Industry players said that, despite the recent declines, the three-year low in June marked the trough in the cycle.

"Oversupply is priced in to the extent that the equity market knows this is a difficult industry. The big picture cycle is long gone, but I think we're on the cusp of a mini cycle," said Michael Shillaker, head of steel and mining research at Credit Suisse.

U.S. steel prices have been supported in the second half of 2013 by a more robust economic recovery, consumer restocking and supply disruptions at major producers AK Steel and U.S. Steel, as well as by a string of anti-dumping actions.

By contrast, markets in the Europe Union and Asia have been held back by tepid economic growth, weak construction demand in Europe, lacklustre export markets in Asia, structural overcapacity and a year-end pause in restocking.

"The U.S. restock normally happens at the end of the year. The restock in Europe and Asia happens into the new year," Shillaker said.

GROWTH HORIZON

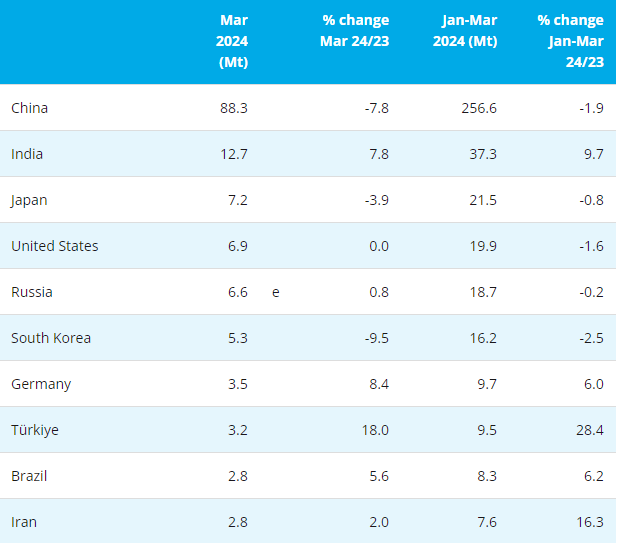

Industry body Worldsteel forecast demand in Europe would grow by 2.1 percent next year as a fledgling economic recovery solidifies. Growth in China, the world's top steel producer and consumer, will be 3 percent as it rolls out reforms to maintain economic growth, it said.

Price gains will be capped, however, as mills respond by increasing production, which may already be starting to occur.

Output in Europe rose on an annual basis in September and October after falling from January through August, while output in China has risen every month this year from the prior month.

Analysts and industry bodies estimate China's overcapacity at 200 million to 300 million tonnes and Europe's at 30 million to 40 million.

"We think (global) price increases will be fairly modest (next year), certainly less than double-digit," said Peter Fish, managing director at UK steel consultancy MEPS.

"With China there's an increase in demand, but that always seems to be matched by an increase in supply. Demand in Europe is going to improve slightly, but we still lost the main driver for steel prices, which is construction."

In the United States, economic conditions have supported prices so far, but the market is at risk of both a supply surge from mills and an uptick in imports as U.S. prices exceed Asian prices by around $160 a tonne, MEPS said.

"The U.S. market is fairly protected in terms of anti-dumping, so a differential can exist and can exist over a long time, but it can't be sustained at current levels," a U.S.-based steel trader said.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:editor]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think