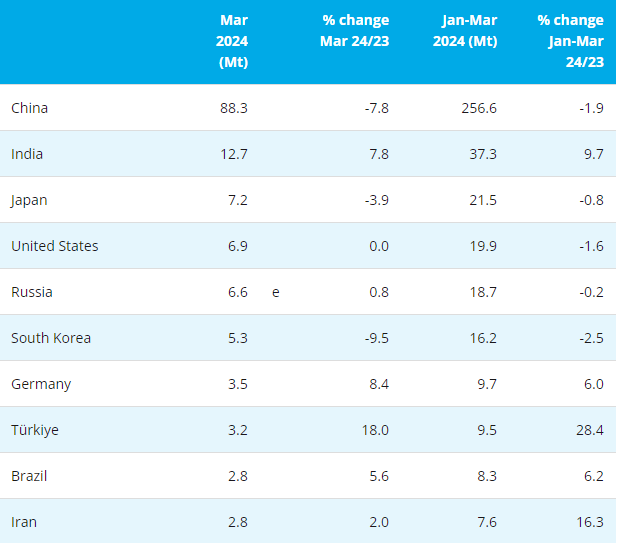

China's record imports of iron ore in November may be as good as they get for a while as a series of factors points to a moderation in the next few months.

Imports surged 18.3 percent from a year earlier to reach 77.84 million tonnes in November, surpassing the prior record of 74.58 million tonnes in September.

For the year to date, imports stand at 746.1 million tonnes, up 10.9 percent over the same period in 2012, making iron ore one of the most imported among China's purchases of major commodities.

Crude oil imports are up only 3.2 percent in the first 11 months of 2013, soybeans have gained 6.6 percent and unwrought copper is down by 4.8 percent.

But iron ore imports may show more moderate growth in coming months amid the winter lull in demand for steel, higher spot prices, rising freight rates and a steepening in the backwardation of the swaps curve.

Iron ore imports show some seasonality, usually peaking between November and January, before tailing off in the first quarter.

While this doesn't preclude the possibility of a gain in imports in December, this year may be similar to the winter of 2011-12 when imports peaked in November, rather than 2012-13 when they topped out in December, or 2010-11 when January was the high.

The reason imports of the steelmaking ingredient may not peak in December or January is that rising prices have in the past acted as a dampener on demand.

Spot iron ore in Asia .IO62-CNI=SI closed at $139.20 a tonne on Dec. 6, near the $139.70 on Dec. 4, which was the highest price in almost four months.

The gains in both prices and volumes have been driven in recent months by a re-stocking in inventories in China, and an improving outlook for steel demand amid signs of stronger infrastructure and other construction spending.

However, inventories of iron ore at Chinese ports have continued to rise, reaching 87.4 million tonnes in the week to Dec. 1, according to data from Mysteel, an industry information service.

This is up from just under 80 million tonnes in mid-November and traders report that mills have been building inventories in recent weeks.

But once iron ore stocks reach comfortable levels, and at the current level of more than a month's imports they are probably there, it's likely mills will buy only as much as they consume.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:editor]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think