[Raw Material] The ex-factory quotation for small-sized semi coke was about 1080-1240 CNY/T; The factory price of silica was around 220-260 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The electricity prices in Inner Mongolia ranged from 0.38 to 0.40 CNY//kWh.

[Spot Market] The enterprise maintained normal production, with limited inventory and cost support, the quotation for 72# ferrosilicon standard blocks was mostly around 6700-6800 CNY/T, while the quotation for 75# ferrosilicon standard blocks was around 7100-7200 CNY/T. Downstream demand has entered a seasonal weakening phase, with insufficient demand for steel, stable and slightly lower prices for magnesium metal. The shipment situation of manufacturers was relatively average, and the transaction atmosphere was slightly cold. Most were cautious and wait-and-see, waiting for the new round of steel tender. The overseas export market has slightly rebounded. According to data of China Customs, in November 2023, China exported 31630.541 tons of ferrosilicon (containing by weight more than 55% of silicon), the month on month increase was 3676.006 tons, an increase of 13.15%.

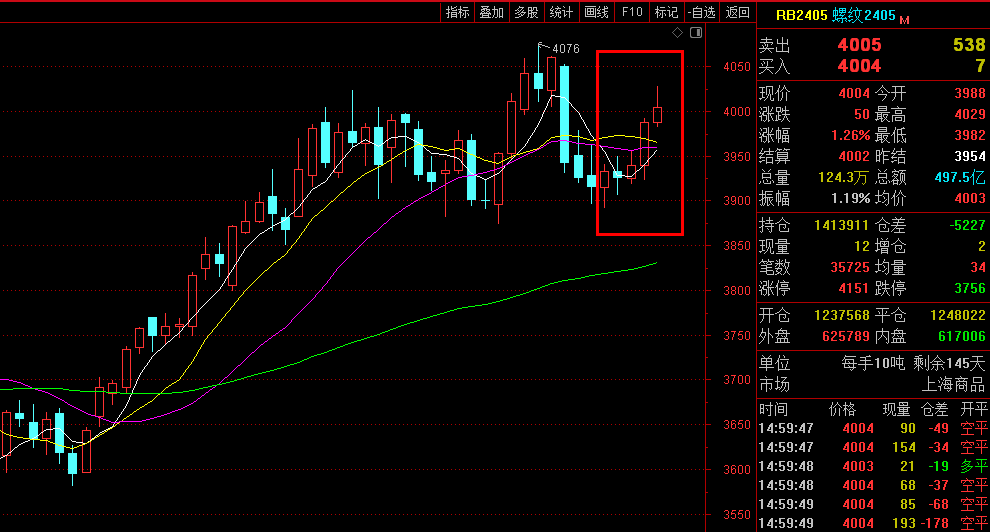

[Futures Market] The opening price of 2402 main contract was 6882, the highest price was 6954, the lowest price was 6766, the closing price was 6868, the settlement price was 6902, the position was 285936, the trading volume was 745755, and the transaction amount was 25.5693 billion yuan, an increase of 0.09%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

12.18 |

6882 |

6942 |

6856 |

6872 |

6896 |

0.15% |

142452 |

351479 |

491097.78 |

|

12.19 |

6872 |

6878 |

6776 |

6792 |

6814 |

-1.51% |

157410 |

340013 |

536219.26 |

|

12.20 |

6792 |

6842 |

6766 |

6820 |

6814 |

0.09% |

128592 |

327896 |

438134.24 |

|

12.21 |

6810 |

6886 |

6810 |

6880 |

6854 |

0.97% |

140079 |

306976 |

479948.63 |

|

12.22 |

6906 |

6954 |

6856 |

6868 |

6902 |

0.20% |

177222 |

285936 |

611526.63 |

[Demand Market] The weather has turned cold and the temperature has dropped, leading to a seasonal weakening of downstream steel demand, resulting in a certain accumulation of inventory. Although the futures market was on the rise, the market's acceptance of high priced products was limited, and the actual transaction situation was not good. The market sentiment was average, and the mentality was cautious. Considering that there was support on the cost side, short-term steel prices may experience pressure fluctuations and slight consolidation.

This week, the domestic magnesium metal market has been weakly stable and consolidating, constrained by the continuous downturn in downstream demand, with no improvement in transactions. Manufacturers slightly lowered their quotations, and prices fluctuated narrowly within the range. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 20400-20500 CNY/T, a decrease of 100 CNY/T compared to last week. The supply and demand sides were still in a stalemate game. Lacking obvious positive factors to stimulate the magnesium market, the pressure still existed, but factories were supported by costs, and the price reduction was expected to be limited. Pay attention to changes in demand and follow up on transactions.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think