This statement comes from Jim Lennon, commodity strategy consultant at Macquarie Bank

Nickel’s outlook is very much determined by China and Indonesia, with the two countries currently making up 70% of global supply and demand of the metal, Lennon said.

The “resource boom in nickel” is predominantly taking place in Indonesia, according to Lennon, who said Indonesia accounts for 55% of current global supply and is expected to grow to over 70% in the next five years.

“Despite the fact that the trend growth rate for nickel demand this decade is 7% a year, the highest of any base metal, we still see ongoing surpluses due to the massive increase in capacity and supply in Indonesia,” Lennon said.

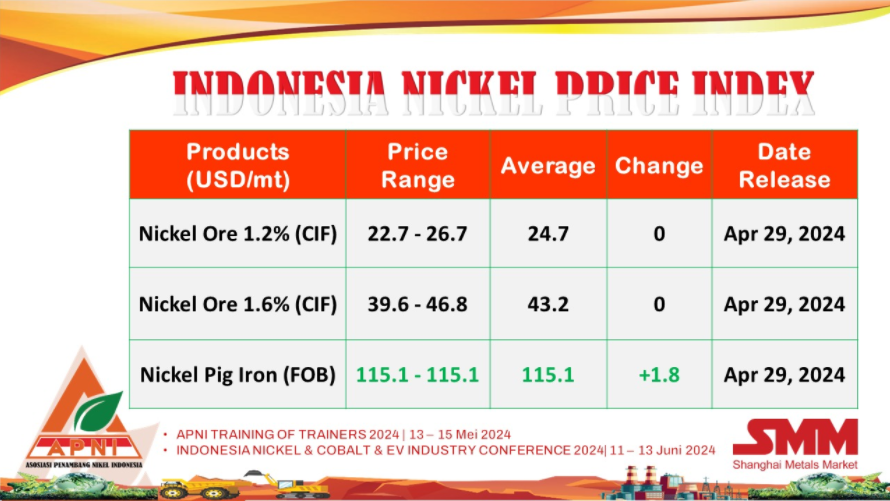

Lennon referred to the “massive divergence” in prices between London Metal Exchange grade nickel, nickel sulfate and nickel pig iron in 2022, saying it has “continued into 2023.”

The price gap between nickel pig iron and the LME nickel price created a “huge opportunity” for processors of nickel pig iron, Lennon said.

These processors have built over 270,000 tonnes of nickel refining capacity to convert nickel matte into Class 1 LME grade nickel, according to Lennon, and this has created an “incredible increase in supply.”

The annualized projection for Class 1 nickel in 2023 is 100,000 tonnes higher than 2022, he also noted.

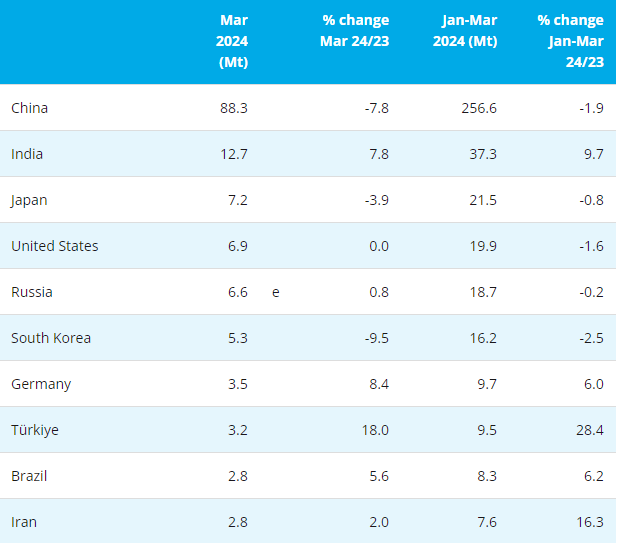

On the demand side, the “huge growth in China is enough to offset the decline elsewhere,” Lennon added.

As a result, the negative sentiment around Europe does not affect nickel as dramatically as the rest of the base metals.

Battery raw materials like nickel, cobalt and lithium have all been “under significant downward pressure, particularly cobalt, over the past couple of years… because of this we’ve seen a savage destocking cycle in the battery raw materials space,” he added.

In contrast to this is the tin market, where limited supply could constrain growth, despite its bullish forecast, panelists said during the same event. fastmarkets

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:kangmingfei]

Save

Save Print

Print

Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think