[Raw Material] The ex-factory quotation for small-sized semi coke was about 1320-1380 CNY/T; The factory price of silica was around 230-260 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The electricity prices in the main production areas ranged from 0.42 to 0.53 CNY//kWh. Cost side support continued to be strong.

[Futures & Spot Market] After the National Day holiday, the futures market of ferrosilicon declined for days. The weekly opening price of the 2312 main contract was 7484, with the highest price being 7484, the lowest price being 7040, the closing price being 7054, the settlement price being 7080, the trading volume being 660088, and the position being 338323, a decrease of 6.30%, driving spot prices to decline. The quotes for 72# ferrosilicon standard blocks in the main production areas mostly around 7000-7100 CNY/T, and quotes for 75# ferrosilicon standard blocks around 7500-7600 CNY/T. At present, there was little fluctuation in the supply side of ferrosilicon, but the demand has slowed down. Steel mills’ profits were under-performance, and there was an expectation of a slight decrease in production. The tender price has been lowered (Xin Steel's new round of ferrosilicon 75B tender price was set at 7500 CNY/T, a decrease of 220 CNY/T compared to before the holiday), and the metal magnesium side has also slightly weakened. Downstream support was insufficient, and the speed of ferrosilicon shipment has slowed down, leading to a growing cautious wait-and-see sentiment.

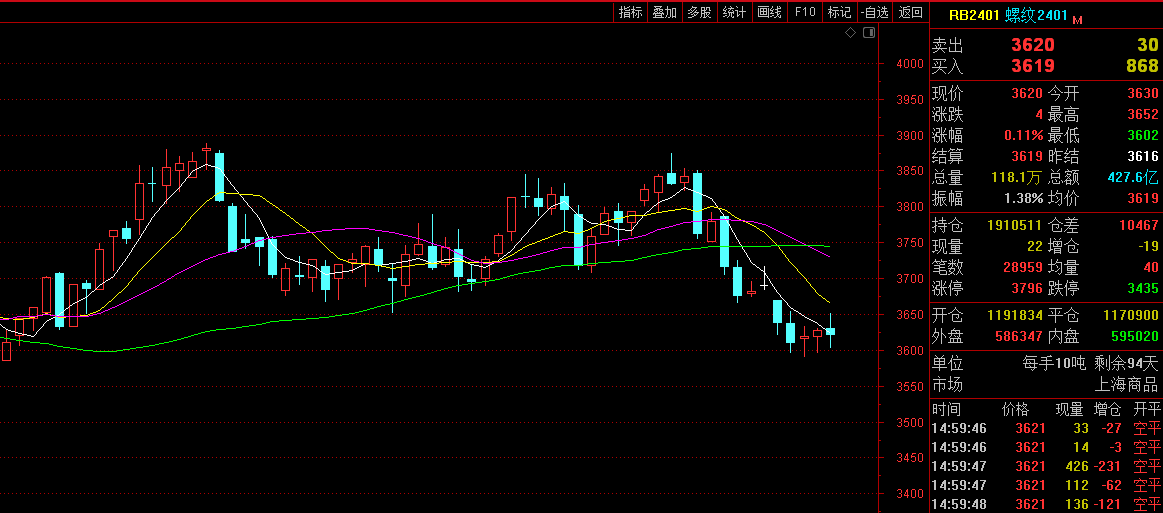

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

10.9 |

7484 |

7484 |

7316 |

7334 |

7352 |

103823 |

247890 |

-2.58% |

|

10.10 |

7338 |

7368 |

7226 |

7236 |

7292 |

98707 |

263057 |

-1.45% |

|

10.11 |

7246 |

7290 |

7140 |

7146 |

7226 |

143305 |

297340 |

-1.13% |

|

10.12 |

7156 |

7186 |

7068 |

7128 |

7124 |

144372 |

319958 |

-0.25% |

|

10.13 |

7106 |

7116 |

7040 |

7054 |

7080 |

169881 |

338323 |

-1.04% |

[Demand Market] According to statistics from the CISA, in early October 2023, key steel enterprises produced a total of 20.8304 million tons of crude steel, with a daily output of 2.083 million tons, an increase of 0.81% month on month; In early October, the statistics showed that the inventory of key steel enterprises was 16.3611 million tons, an increase of 1.1142 million tons or 7.31% compared to the previous ten days (i.e. late September); An increase of 557700 tons or 3.53% compared to the same period last month. After the holiday, steel demand contracted, and the market trading atmosphere was average. Steel prices continued to decline slightly. Although there was a slight rebound in the futures market in the middle and later stages of this week, the impact was limited. The profits of steel mills were poor, and there was an increase in maintenance and production reduction; At present, the market sentiment was relatively low, cautious wait-and-see was the main trend,but some people still had expectations for the performance of the "Silver October".

Due to factors such as insufficient demand follow-up and difficulties for downstream users to accept high prices, magnesium prices have fallen under pressure this week. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 23800-24000 CNY/T. However, some factories have stated that although there were currently not many orders and the market was relatively flat, they were not willing to continue to reduce prices for sales. They believed that the current prices have dropped to a level acceptable to downstream customers and expected transactions to improve. However, considering the certain inventory pressure on the supply side, it was difficult for the magnesium market to experience a significant reversal in the short term. Follow up on demand.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think