[Raw Material] The ex-factory quotation for small-sized semi coke was increased to about 1360 CNY/T; The factory price of silica was around 220-260 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The electricity prices in the main production areas ranged from 0.42 to 0.53 CNY//kWh. Cost side support continued to be strong.

[Spot Market] Supported by multiple positive factors such as an increase in the price of raw materials, a slight increase in export volume (the exports of ferrosilicon, containing by weight more than 55% of silicon, increased over 3000 tons month on month in August), a strong metal magnesium market, and strong expectations for downstream restock before the National Day holiday (some steel mills have already released a new round of tender information in advance), the domestic ferrosilicon market has shown good confidence this week, with prices rising. The quotes for 72# ferrosilicon standard blocks in the main production areas mostly around 7200-7300 CNY/T, and quotes for 75# ferrosilicon standard blocks around 7500-7600 CNY/T, and it was expected that the price would mainly be high before the National Day holiday.

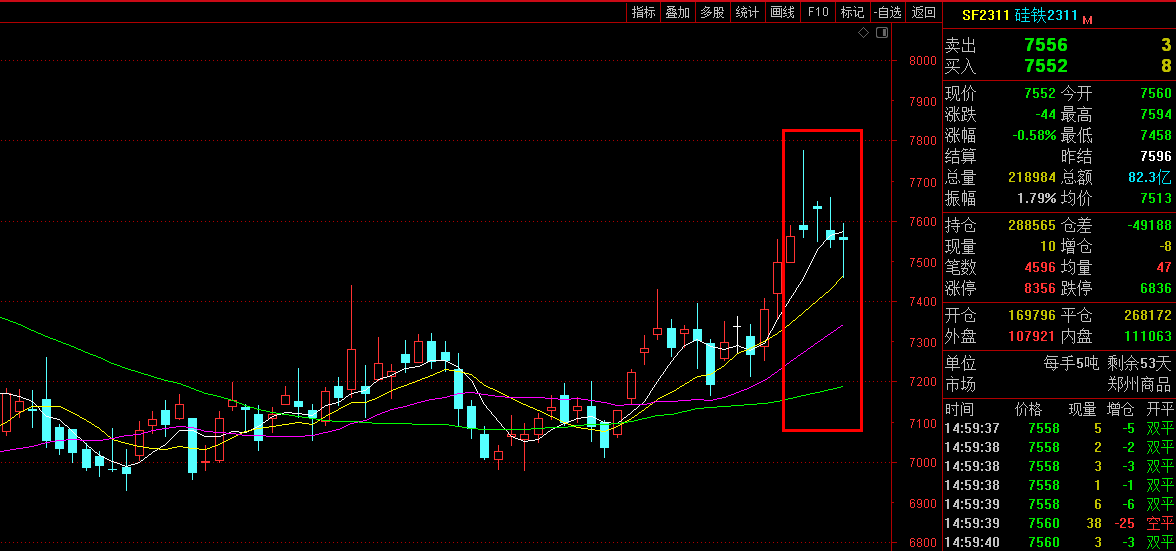

[Futures Market] The futures market fluctuated at high levels, with the opening price of the 2311 main contract being 7498, the highest price being 7776, the lowest price being 7458, the closing price being 7554, the settlement price being 7514, the trading volume being 1055988, and the position being 288527, an increase of 0.72%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

9.18 |

7498 |

7592 |

7498 |

7562 |

7558 |

199520 |

425235 |

1.56% |

|

9.19 |

7588 |

7776 |

7558 |

7576 |

7646 |

291140 |

393781 |

0.24% |

|

9.20 |

7636 |

7648 |

7546 |

7628 |

7606 |

157235 |

371734 |

-0.21% |

|

9.21 |

7578 |

7658 |

7532 |

7552 |

7596 |

189038 |

337753 |

-0.71% |

|

9.22 |

7560 |

7594 |

7458 |

7554 |

7514 |

219055 |

288527 |

-0.58% |

[Demand Market] The price of raw materials was relatively strong, and the terminal demand has improved, while the supply has slightly increased; However, the recovery of downstream demand was difficult, and although inventory continued to be de-stocking, the pressure was still significant, this week, steel prices were operating weakly. But on the other hand, the market still had expectations for the pre-National Day market, supported by favorable macroeconomic policies, and short-term steel prices may fluctuate, with cautious and optimistic sentiment.

The magnesium market has been operating steadily at a high level this week, and on Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 24600-24700 CNY/T. Downstream acceptance of high prices was still hard, and purchasing sentiment was relatively cautious; However, due to favorable factors such as pre-holiday stocking expectations and price support for raw materials such as ferrosilicon and coal, factories had a strong willingness to support prices, resulting in a scarcity of low-priced goods in the market. It was expected that the short-term market would continue to be dominated by high consolidation.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think