[Raw Material] The raw material end was temporarily running stably. It was learned that the ex-factory price of silica was around 200-250 CNY/T, the ex-factory price of small-sized semi coke was around 970-1060 CNY/T, the oxide skin was around 1000-1030 CNY/T, and the electrode paste price was around 5400 CNY/T; In terms of electricity prices, following Ningxia, market news suggested that the electricity prices in Inner Mongolia may increase by about 2 cents. The current cost side support was relatively strong.

[Spot Market] At the beginning of this week, the quotation of ferrosilicon continued to be strong, but as the futures market continued to decline, the downstream off-season characteristics were obvious, coupled with the continued poor export situation, the confidence of the spot end was affected, and the quotation was slightly lowered, but stabilized in the later part of the week; On he other hand, the rise in the market for magnesium metal has supported the price of 75# ferrosilicon. The quotation for 72# ferrosilicon standard block in the main production area was around 6800-6900 CNY/T, while the quotation for 75# ferrosilicon standard block was around 7300-7400 CNY/T. The inventory pressure of manufacturers was not high, and they had a strong willing to strong the price, it’s difficult to find low-priced goods in the market; In addition, with the restoration of profits, the mood has improved, and production enthusiasm was high. Manufacturers in Ningxia, Inner Mongolia and other regions had gradually resumed production or would add new capacity. However, the downstream side was still in the off-season, with low willingness to compromise and there was a strong sense of game between the two sides.

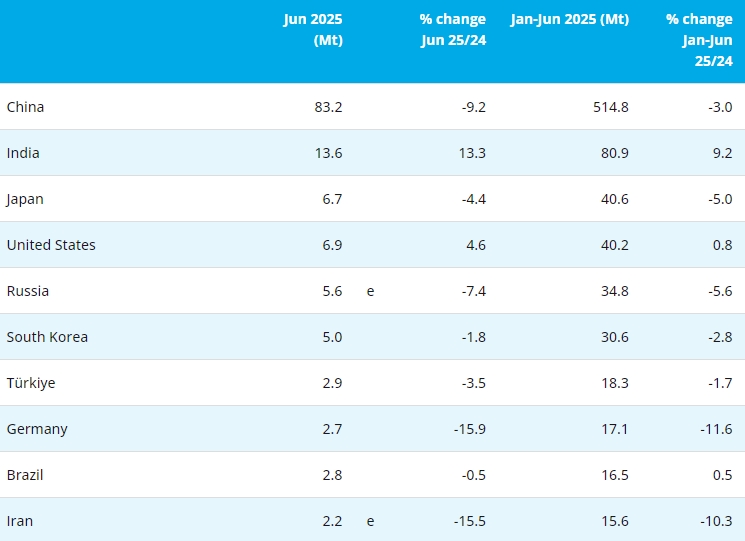

[Futures Market] At the beginning of this week, the futures plummeted significantly, and began to rebound slightly on Thursday. The weekly opening price of the 2310 main contract was 7070, with a maximum price of 7108, a minimum price of 6786, a closing price of 6874, a settlement price of 6886, a trading volume of 1072946, and a position of 408908, a decrease of 3.07%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

8.14 |

7070 |

7108 |

6892 |

6932 |

6962 |

329623 |

417631 |

-2.28% |

|

8.15 |

6960 |

6960 |

6860 |

6890 |

6906 |

194324 |

425719 |

-1.03% |

|

8.16 |

6884 |

6904 |

6816 |

6822 |

6848 |

185897 |

432934 |

-1.27% |

|

8.17 |

6818 |

6868 |

6786 |

6842 |

6830 |

174022 |

428880 |

-0.09% |

|

8.18 |

6874 |

6928 |

6850 |

6874 |

6886 |

189080 |

408908 |

0.64% |

[Demand Market] It was reported that the "production control" requirements for crude steel were gradually being implemented in many regions. Considering that would help alleviate supply pressure, this futures market rose, inventory decreased month on month, market confidence improved, and market started being stronger. However, the characteristics of the traditional off-season consumption were still relatively obvious, and downstream demand resilience was insufficient. At the same time, there was still room for further development of relevant policies, and the traditional peak season was approaching, the market was mostly optimistic about the situation in the fourth quarter.

This week, the domestic magnesium metal market remained stable and strong overall. At the beginning of the week, the price slightly loosened, but quickly rebounded as downstream demand concentrated procurement. At present, in a positive environment of further contraction on the supply side and no inventory pressure on factories, market confidence was good. However, as usual, there were not many transactions under high prices, and there has been no significant improvement in downstream demand, the majority were wait-and-see, and the probability of magnesium prices continued to rise significantly was not high. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 21900-22000 CNY/T. Pay attention to the supply and demand relationships.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think