The quotation for 72# ferrosilicon standard blocks in the main production areas was around 6800-6900 CNY/T, while that for 75# ferrosilicon standard blocks was around 7200-7300 CNY/T, ramained stable compared to last week, it lacked of support for price increasing, and the actual transaction was average. Manufacturers were not very optimistic about off-season demand and had a strong cautious wait-and-see attitude.

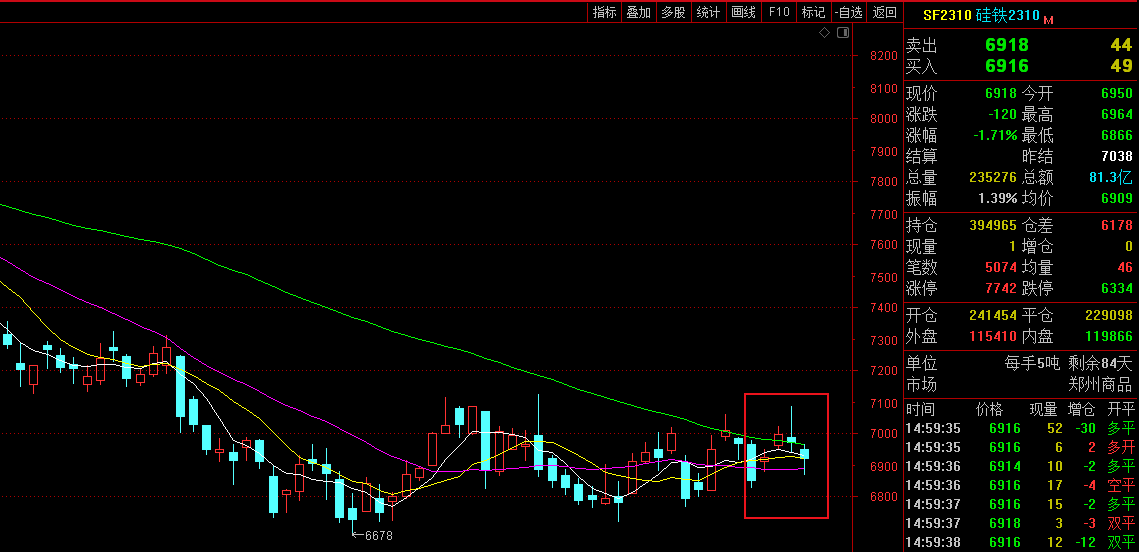

Futures market: The Futures continued to fluctuate this week. The opening price of the 2310 main contract was 6,966, the highest price was 7,084, the lowest price was 6,824, the closing price was 6,914, the settlement price was 6,910, the trading volume was 1,103,494, and the position of 394,905, a decrease of 0.49%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

7.24 |

6966 |

6976 |

6824 |

6848 |

6880 |

228070 |

387213 |

-1.50% |

|

7.25 |

6910 |

6952 |

6874 |

6922 |

6912 |

187320 |

377306 |

0.61% |

|

7.26 |

6962 |

7026 |

6950 |

6996 |

7000 |

223605 |

386286 |

1.22% |

|

7.27 |

6986 |

7084 |

6940 |

6968 |

7038 |

228914 |

388787 |

-0.46% |

|

7.28 |

6950 |

6964 |

6866 |

6914 |

6910 |

235585 |

394905 |

-1.71% |

Supply side: The price of raw material was temporarily stable, and the cost of ferrosilicon production has not changed much. Some factories in certain regions continued to implement the resumption plan, but the increase in production was limited, and some factories have also ceased production.

Demand side: On July 25th, the Market Committee of China Coke Association held a market analysis meeting, and the participating enterprises agreed to optimize sales channels. For customers who refused to accept price increases, they would resolutely reduce or stop shipments. It was reported that some steel mills have accepted the third round of coke price increases. On July 27th, some of the 14 steel mills in Anhui Province received notices related to "level control", stating that their production couldn't increase compared to the same period in 2022. Recently, the positive stimulations of the steel market increased, and the Futures market rose, which led to the improvement of the spot market sentiment. The overall inventory pressure was not large, and the steel mills were willing to raise prices. However, due to the impact of high temperature, rainstorm or typhoon in many places, the demand in the off-season was still unstable, and the short-term steel price may fluctuate slightly.

In the last week of July, the domestic metal magnesium market recovered. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 21300-21500 CNY/T, exceeding market expectations. Recently, factory inventory has significantly decreased and there was a strong willingness to increase prices. However, downstream acceptance of high priced goods was still not strong, and the operating pressure of the magnesium market was still ongoing. Moreover, the current market was slightly chaotic with inconsistent quotations. It was expected that the future operations would be more cautious.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think