Downstream demand and transactions remained lackluster, and the domestic ferrosilicon market continued to operate weakly and steadily this week. The price of magnesium metal has rationally declined after last week's surge, and the support for the high price of 75 # ferrosilicon was insufficient. The market has not changed much compared to late last week; The production end was mostly avoiding peak production or production reduction, and inventory was relatively high. On Tuesday, Qinghai released a notice on the 2023 peak summer electricity management plan, which implemented a rotating stop and rest system for ferroalloy and other enterprises according to the corresponding level of the plan. The Futures market rose significantly on Tuesday and Wednesday, but due to the actual impact was not reflected temporarily, on Thursday and Friday, the Futures quickly declined. At present, the market mentality was mainly cautious and wait-and-see, and it was expected that the short-term market would continue to be dominated by volatile consolidation and weak stability.

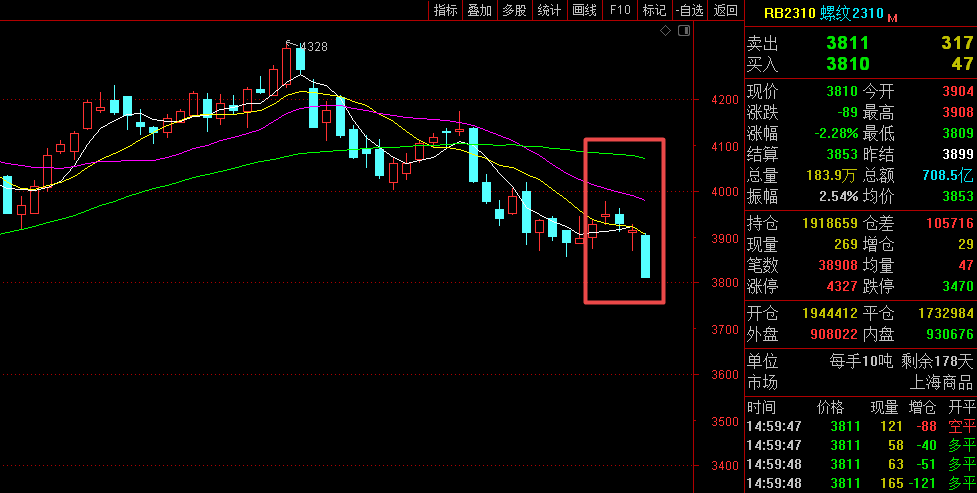

The weekly opening price of the 2306 main contract was 7,670, with a highest price of 7,794, a lowest price of 7,412, a closing price of 7,444, a settlement price of 7,468, a trading volume of 818,560, and a position of 200,396, down 3.07%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

4.17 |

7670 |

7670 |

7466 |

7526 |

7534 |

152465 |

182302 |

-2.01% |

|

4.18 |

7550 |

7750 |

7542 |

7740 |

7666 |

193147 |

172003 |

2.73% |

|

4.19 |

7740 |

7794 |

7724 |

7766 |

7762 |

121861 |

171845 |

1.30% |

|

4.20 |

7740 |

7740 |

7558 |

7604 |

7610 |

162537 |

177016 |

-2.04% |

|

4.21 |

7528 |

7538 |

7412 |

7444 |

7468 |

188550 |

200396 |

-2.18% |

Downstream, according to data from the National Bureau of Statistics, in March 2023, China's crude steel production reached 95.73 million tons, a year-on-year increase of 6.9%; The daily average production of crude steel in China was 3.088 million tons, an increase of 8.0% compared to the previous month; From January to March, China's crude steel production reached 261.56 million tons, a year-on-year increase of 6.1%. The year-on-year increase in crude steel production in the first quarter of five provinces exceeded 20%, with Hebei increasing by 21.47%, Fujian increasing by 41.94%, Tianjin increasing by 32.09%, Shanghai increasing by 27.35%, and Chongqing increasing by 37.55%. The current demand for steel was still weak, and transactions were not ideal, with Futures fluctuating downward. However, considering the increase in regional maintenance in steel mills, the decline in production, and the approaching May Day holiday, the demand for replenishment before the holiday was expected to increase, which would alleviate the short-term supply-demand contradiction to some extent.

There was currently no follow-up news on the transformation of the semi-coke and magnesium metal industry in the Fugu region. In addition, the actual supply and demand pattern of the magnesium market has not fundamentally changed. After experiencing last week's violent rise, domestic magnesium prices returned to a rational state this week. However, due to the uncertainty of the policy news, the range of factory price reductions was limited. On Friday, April 21st, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly about 25000 CNY/T. Pay attention to policy progress and demand follow-up.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think