From April 10th to 14th, the HBIS Group finalized the tender price for 72# ferrosilicon at 7880 CNY/T, a decrease of 270 CNY/T compared to the previous month, but an increase of 80 CNY/T compared to the previous inquiry, with a quantity of 2482 tons and an increase of 899 tons compared to the previous month. Driven by the soaring price of downstream magnesium metal, the price of 75# ferrosilicon has climbed to around 8200-8400 CNY/T, and large factories offered 8500 CNY/T; Futures market fluctuated upward; The spot market was steadily rising slightly. However, downstream acceptance of high prices was limited, actual transactions were under-performing, and there was no fundamental change in supply and demand pattern. Currently, the overall market mentality was relatively rational. Pay attention to the Futures market trend and changes in supply and demand relations.

The weekly opening price of the 2305 main contract was 7736, with a highest price of 7938, a lowest price of 7656, a closing price of 7866, a settlement price of 7884, a trading volume of 541146, and a position of 95532, an increase of 1.13%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

4.10 |

7736 |

7760 |

7656 |

7700 |

7712 |

118717 |

139099 |

-1.00% |

|

4.11 |

7718 |

7802 |

7662 |

7796 |

7728 |

100363 |

130627 |

1.09% |

|

4.12 |

7760 |

7836 |

7746 |

7814 |

7802 |

109409 |

122216 |

1.11% |

|

4.13 |

7800 |

7888 |

7800 |

7832 |

7850 |

111133 |

106595 |

0.38% |

|

4.14 |

7852 |

7938 |

7842 |

7866 |

7884 |

101524 |

95532 |

0.20% |

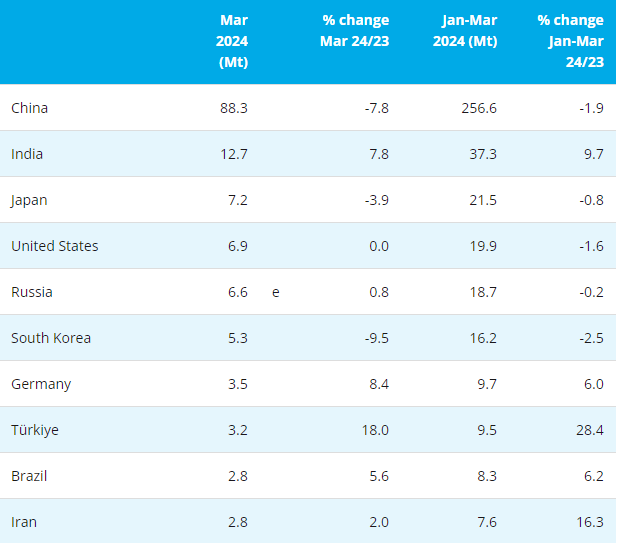

According to data from CISA, in early April, key steel enterprises produced a total of 23.2196 million tons of crude steel, with a daily output of 2.322 million tons, an increase of 2.71% month on month; In early April, the social inventory of 5 major varieties of steel in 21 cities reached 12.18 million tons, a decrease of 130000 tons compared to the previous month, a decrease of 1.1%, and the decline in inventory narrowed. Due to the average performance of actual demand, the speed of destocking has slowed down, and steel prices have been operating in a weak and volatile manner recently. Currently, the profit per ton of steel was poor, and the loss of electric furnace steel mills has increased. The steel mills have actively stopped production or reduced production. Under high inventory and low demand, short-term steel prices would still mainly operate in a volatile manner.

Affected by the news of the transformation of the semi-coke and metal magnesium industry in the Fugu region, the magnesium market has launched a fierce counterattack, driving up the price of magnesium from 22000 CNY/T on Monday to the highest quotation of 30000 CNY/T on Friday. Some downstream users were worried that prices may continue to rise, so there were transactions at high prices; But some users still maintained a rational mindset and were cautious. On Friday, April 14th, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly about 2800-29000 CNY/T. However, there was no fundamental change in the actual supply and demand pattern of the magnesium market, and whether the subsequent upward trend can be sustained still rely on the relevant policy dynamics.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think