[Ferrosilicon Bidding] The steel bidding information in December was released in succession, the price increased by 200-300 yuan per ton. In December, the bidding volume of ferrosilicon of HBIS Group was 2240 tons, with an increase of 874 tons on a month on month basis and the first round of inquiry price was 6350 yuan per ton, up 180 yuan per ton month on month.

[Market Information] On December 3, 2020, Ningxia Zhongwei issued the notice on staggering peak production in some key industrial industries during winter and spring 2020-2021. Some ferroalloy (ferrosilicon) enterprises were included in the staggered peak production range. The peak shifting production time is from December 1, 2020 to March 10, 2021. According to local enterprises, it will affect the overall output, supply schedule and market sentiment to some extent.

At 9:00 a.m. on December 3, 2020, Fugu Magnesium Association and Semi-coke Association held an emergency meeting. They pointed out that the current guiding price for magnesium ingots storage was 14000 yuan per ton including tax, and required the manufacturers to make firm quotations (830 yuan per ton of medium sizes and 800 yuan per ton of small sizes of semi-coke) to reduce losses. How to reduce production are also discussed.

Ningxia and Gansu have issued electricity price adjustment policies, and the impact is not very clear at present.

[Spot Market] This week, the spot market of ferrosilicon continued to be stable, and manufacturers were tight in the inventories. Supported by the strong cost of raw materials and the current stable downstream demand, the futures market was up, as well as the peak shifting production in Ningxia, the market confidence was good and the ex-factory price of 72# is 6000 yuan per ton. Pay attention to the change of output and downstream demand; pay attention to the possible follow-up impact of price adjustment in Ningxia and Gansu; pay attention to the uncertainty caused by the change of futures market and delivery warehouse supply.

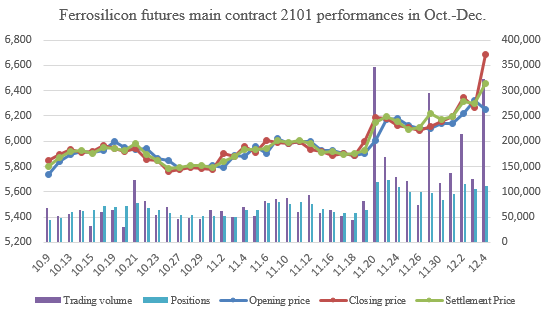

[Ferrosilicon Futures 2101 Contract] Opening price of ferrosilicon futures 2101 contract of this week was 6,138, highest price was 6,682, lowest price was 6,110, closing price was 6,682 and the settlement price was 6,458. The trading volumes were 918,400 and the positions were 110,698.

[Steel Market] With the arrival of cold weather, the construction progress is hindered or even shut down. In the traditional off-season, steel demand in December is not optimistic. However, some analysts believe that the demand is higher than the previous years' level. On the other hand, the overall inventory level is also higher than the previous year's level. Although the output is slightly reduced, the impact is not obvious, and the steel price in December may tend to be rationally fall back.

[Metal Magnesium Market] Raw coal, ferrosilicon and other raw materials prices are strong, purchasing atmosphere and storage support, the domestic magnesium ingot market continued to improve this week, the magnesium price increased by 200 yuan per ton. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 13900-14000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think