The Northern China import price of 62% Fe content ore gained 1.2% on Tuesday to trade at $64.70 per dry metric ton according to data supplied by The Steel Index. It's the highest price since the beginning of May and the steelmaking raw material is now firmly back in a bull market after adding 22% in value from year lows hit mid-June.

Iron ore's latest rally comes after Shanghai rebar futures – the world's most traded steel contract – jumped to the highest level since end-2013 on Tuesday according to Reuters. The most-active rebar contracts on the Shanghai Futures Exchange rose as high as 3,597 yuan ($528) a ton on Tuesday and closed 3.7% higher on the day. Open interest – a measure of market participation – came close to the record reached last week.

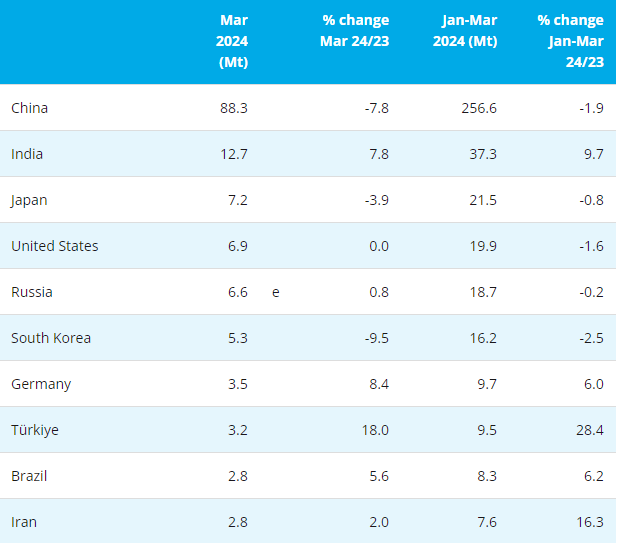

Chinese traders are worried about a supply crunch and low stockpiles as Beijing steps ups efforts to crack down on polluting steel plants. Some 120 million tons of low-quality steel capacity were shuttered during the first six month of the year and authorities are now sending inspection teams to check the results of the program.

Beijing's policies to clean up and consolidate the domestic steel industry is also playing into the hands of iron ore exporting countries with low grade furnaces – particularly those that use scrap – being forced out of business. Authorities are also clamping down on pollution from sintering plants, a necessary extra step when using low grade ore (domestic Chinese iron content averages only about 20%) to make steel.

However, fundamental factors continue to cloud the outlook for iron ore which has been in oversupply for more than two years. Iron ore inventories at the country's ports remain near all-time highs dipping to 139.3 million tons compared to the record set June 23 at 141.5 million tons according to Steelhome data.

FocusEconomics in its July survey of analysts and institutions released today shows the price of iron ore averaging $58.40 a ton during the final quarter of 2017. For Q4 2018, the median price of analysts forecasts are expected to moderate further to average $55 over the three month period.

Canada's RBC Capital Markets and London-based investment bank Investec are the most optimistic calling for a $70 average towards the end of 2017.

Deutsche Bank sees prices correcting sharply from today's levels to average $50 in Q4 2017 before recovering to above $60 at the start of 2018. Macquarie also expects iron ore to average a half-century end of this year, but the Australian specialist bank sees a drop to just $45 a ton by the end of next year.

Consensus forecasts of the 16 institutions surveyed are pegged at $65.10 for the full year 2017 (compared to year-to-date average of $73.20) falling to $57.50 over the course of 2018.

- [Editor:Wang Linyan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think