Most vanadium has traditionally been used to strengthen steel but the metal is now also being employed as a component in batteries to store large amounts of power from renewable energy sources or to balance the grid when there are surges in demand.

American Vanadium, which is listed on the Toronto Stock Exchange, currently sells "CellCube" vanadium flow batteries made by German technology firm DMG Mori Seki.

It is also developing its own vanadium mine in Nevada so it has its own supply of the metal to produce electrolytes for vanadium flow batteries.

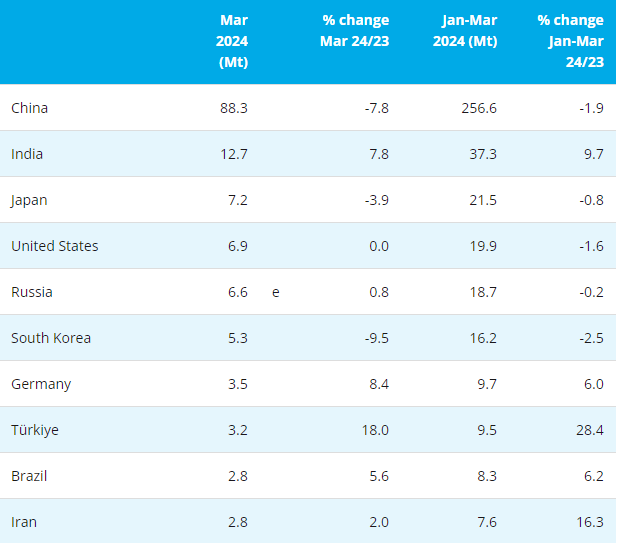

China is currently the world's biggest vanadium producer and consumer. Russia and South Africa also have significant resources.

American Vanadium expects its Gibellini mine - the only vanadium mine in the United States - to produce 11 million pounds (lbs) a year of vanadium pentoxide from 2017 which will be turned into electrolytes for energy storage batteries.

"The long-duration flow battery market is expected to be worth $5 billion in 2020. The CellCube is expected to be a major global player, capturing at least 20 percent of the market by then," Bill Radvak, the company's president and chief executive, said in an interview.

The electrolytes for flow batteries sell at around $25 a pound weight equivalent, compared to just $6.50 a pound for vanadium pentoxide for the steel-strengthening market, Radvak said.

"We are able to increase our margins several-fold by going into the electrolyte business," he added.

STORAGE NEEDS

Global demand for vanadium for use in strengthening steel is expected to double by 2025 from around 80,000 tonnes in 2012 and energy storage applications will add significantly to that, Radvak said.

Energy storage technologies, such as pumped hydro or advanced batteries, can help to manage the amount of power needed at peak times and variable supply from renewable energy sources.

The International Energy Agency has estimated that around 310 gigawatts of additional electricity storage capacity is needed in the United States, Europe, China and India to support more low-carbon power generation.

Vanadium flow batteries have a lower energy density than other types and are expensive, but have long lifetimes.

"The cost of these batteries is considered a high upfront capital cost but when they work for 20 years reliably every day, your return on the purchase is spectacular," Radvak said.

CellCube will be installed this year at the U.S. National Renewable Energy laboratory in Colorado and at the Metropolitan Transit Authority's building in New York City, he added.

Other players in the flow battery market include Japan's Sumitomo Electric and China's Dalian Bolong New Materials Co., but Radvak said CellCube was the only commercially-available vanadium flow battery at present.

- [Editor:Mango]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think