This week, the ferrosilicon market continued to operate steadily, the supply side was generally stable, the inventory was still tight, and some enterprises avoided peak production; Following the announcement of ferrosilicon tender price in December by HBIS Group last week, the subsequent steel tender price has slightly increased. The tender price of some steel plants was around 8800 CNY/T, which brought confidence to the market and low-price goods in the market has decreased, and the factories were willing to strong the price; In addition, with the steel recruitment at the end of the year in succession, the demand was released intensively. In addition, some steel mills began to stock up for the Spring Festival in advance, which drove the market transactions. The Futures market fluctuated at a high level. Some manufacturers said that before the Spring Festival, the price of ferrosilicon had a high probability of maintaining a firm and good operating situation, which was easy to rise but difficult to fall. Analysts from Ferro-Alloy.com believed that the stock purchase of steel mills was expected to continue until the end of February, and the market would remain stable until the first quarter of next year.

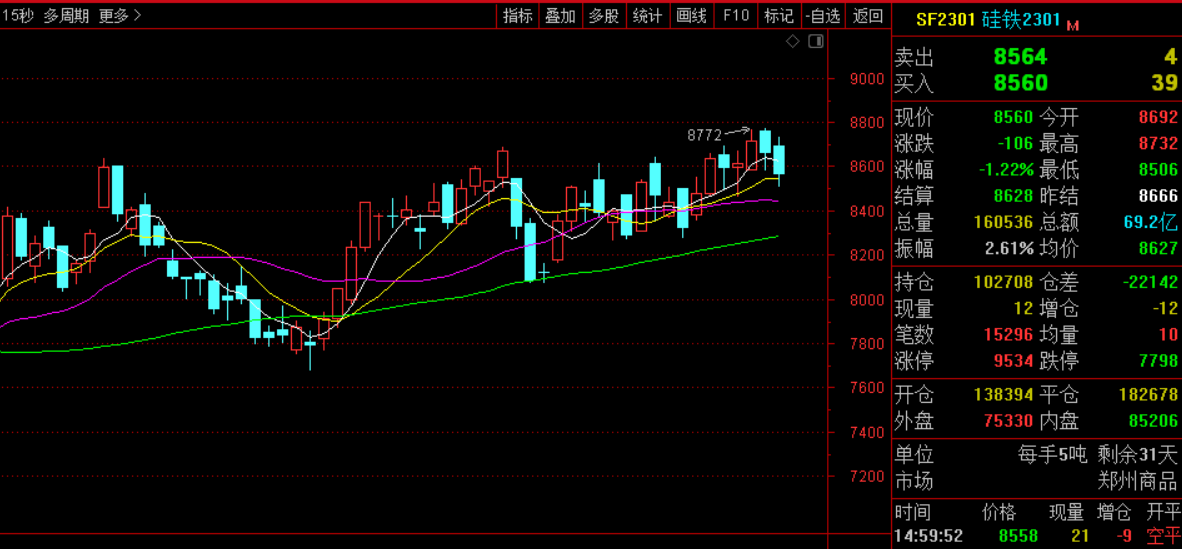

This week, the opening price of 2301 main contract was 8,652, the highest price was 8,772, the lowest price was 8,460, the closing price was 8,560, the settlement price was 8,628, the trading volume was 786,825, and the position was 102,708, down 0.07%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

12.12 |

8652 |

8690 |

8496 |

8588 |

8590 |

150726 |

143093 |

0.26% |

|

12.13 |

8598 |

8678 |

8460 |

8612 |

8566 |

163071 |

134114 |

0.26% |

|

12.14 |

8586 |

8772 |

8578 |

8714 |

8678 |

173444 |

143364 |

1.73% |

|

12.15 |

8760 |

8770 |

8580 |

8660 |

8666 |

139048 |

124850 |

-0.21% |

|

12.16 |

8692 |

8732 |

8506 |

8560 |

8628 |

160536 |

102708 |

-1.22% |

In the downstream, according to the data of National Bureau of Statistics, in November 2022, China's crude steel output was 74.54 million tons, up 7.3% year on year, with an average daily output of 2.4847 million tons, down 3.4% month on month; According to the data of China Iron and Steel Association, in the first ten days of December, the key steel enterprises produced 19.8669 million tons of crude steel, with a daily output of 1.9867 million tons, down 2.06% month on month; The steel inventory of iron and steel enterprises was 15.3415 million tons, an increase of 37600 tons or 0.25% over the previous ten days (the end of last month); 1.3803 million tons or 8.25% less than that in the same ten day of last month; It increased by 1.999 million tons or 14.98% over the same period last year. With the continuous increase of macro policies, the recent shipment of some markets has warmed up, the willingness of downstream winter storage has also been strengthened, the inventory has decreased significantly, and the rise in prices has led to an increase in apparent consumption.

Affected by the continued weak demand and lack of positive support, the magnesium market fell under pressure this week, breaking through a new low. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 21600-21700 CNY/T, down about 600 CNY/T compared with last week. Market sentiment was affected. Under the market pattern of oversupply, it’s hard to say that the market was optimistic in the short term, and the stabilization was still weak.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think