【Weekly Review】

(12.7-12.11)

Ferro-alloys.com:

【Factory】:This week the silicomanganese market is still weak but stable

At present, the silico-manganese alloy futures market has increased sharply compared with the previous situation (this week, the silico-manganese 2101 contract surged and fell, the highest was 6766 points, the lowest was 6492 points, and it closed at 6508 points, a decrease of nearly 1%), in recent days The performance of futures was relatively ordinary and the callback was obvious. Today, the highest reached 6564 points, the lowest was 6314 points, and closed at 6316 points, a decrease of about 0.6%. There was a difference of 494 points between the highest and lowest points during the week.

In terms of spot, the price of a large-scale steel group in North China for the bidding of silico-manganese alloy in December was finalized at 6,350 yuan/ton. The overall direction is clear for this, and the market inquiries and purchases are relatively active. In addition, under the influence of multiple factors such as the relatively general acceptance of high prices in the market, the recent silico-manganese alloy market has begun to return to rationality, and the quotations of some companies have been adjusted. Compared with the 200-300 yuan quotations of the previous few days, the quotations have risen slightly, and they have slightly corrected.Although pallets have performed poorly in recent days and spot prices have been adjusted, supply and demand determine prices. Spot supplies in enterprises are still tight, news of production restrictions in Ningxia continues to ferment, costs have increased, and the tender situation has been introduced. In many cases, most factories are now willing to uphold prices, and the sentiment of lowering prices and selling goods is not high.

In terms of manganese ore, due to the long-term cost upside down, miners are not motivated to further cut prices and sell goods, and most of them are willing to pay more. However, the acceptance of high-priced goods is quite ordinary, and the port inventory remains high. The rise and fall of current manganese ore prices are difficult. The state is slightly stalemate. Compared with the previous callback of about 0.5 yuan, the overall operation is stable.

As of this Friday, Si-Manganese 6517# in Inner Mongolia is quoted at 6100-6200 yuan/ton, Si-Manganese 6517# in Ningxia is quoted at 6100-6200 yuan/ton, Si-Manganese 6517# in Guangxi is quoted at 6100-6200 yuan/ton, and Si-Manganese 6517# in Chongqing is quoted at 6100-6200 yuan/ton, and the price trend this week is shown in the figure:

1、Price Quotation(Silicon Manganese)

|

Date |

Inner Mongolia |

Ningxia |

Guizhou |

Guangxi |

Chongqing |

|

Dec.7th |

6000-6100 |

5900-6000 |

6000-6100 |

6000-6100 |

6100-6200 |

|

Dec.8th |

6000-6100 |

5900-6000 |

6000-6100 |

6000-6100 |

6100-6200 |

|

Dec.9th |

6200-6300 |

6200-6300 |

6200-6300 |

6200-6300 |

6200-6300 |

|

Dec.10th |

6200-6300 |

6200-6300 |

6200-6300 |

6200-6300 |

6200-6300 |

|

Dec.11th |

6100-6200 |

6100-6200 |

6100-6200 |

6100-6200 |

6100-6200 |

【Steel Mills】

|

bid price of representative steel mills in December |

||

|

steel mills |

price |

quantity |

|

HBIS |

6350 |

24400 |

|

NISCO |

6280/6300 |

9000 |

|

XISC |

6310 |

8000 |

|

Shagang Group |

6350 |

12000 |

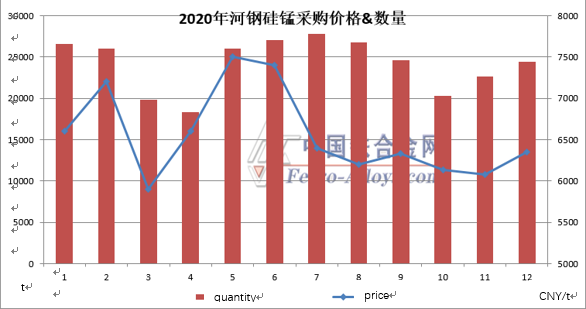

Hegang Group’s bidding price in December for silico-manganese 6517 was finally finalized at 6,350 yuan/ton, an increase of 70 yuan/ton from the second inquiry price, and an increase of 270 yuan/ton from the previous month’s bidding price, and the bidding volume was 24,400 tons.The specific price-volume relationship is as follows:

2、Price Quotation(manganese ore)

(1)、The northern port CNY/mtu

|

date |

Australian Manganese OreMn46% |

Australian Manganese Ore(lumpy)Mn45% |

Gabonese Manganese OreMn45% |

Brazil manganese ore 46% |

South Africa semi-carbonate Mn37% |

South Africa Ferro Manganese Ore 30% |

|

Dec.7th |

34.5-35 |

34.5-35 |

32-32.5 |

29-29.5 |

31-31.5 |

28-28.5 |

|

Dec.8th |

34.5-35 |

34.5-35 |

32-32.5 |

29-29.5 |

31-31.5 |

28-28.5 |

|

Dec.9th |

34.5-35 |

34.5-35 |

32-32.5 |

29-29.5 |

31-31.5 |

28-28.5 |

|

Dec.10th |

34.5-35 |

34.5-35 |

32-32.5 |

29-29.5 |

31-31.5 |

28-28.5 |

|

Dec.11th |

34.5-35 |

34.5-35 |

32-32.5 |

29-29.5 |

31-31.5 |

28-28.5 |

(2)、The southern port CNY/mtu

|

date |

Australian Manganese OreMn46% |

Australian Manganese Ore(lumpy)Mn45% |

Gabonese Manganese OreMn45% |

Brazil manganese ore 46% |

South Africa semi-carbonate Mn37% |

South Africa Ferro Manganese Ore 30% |

|

Dec.7th |

35-35.5 |

34.5-35 |

32-32.5 |

29-29.5 |

32-32.5 |

29-30 |

|

Dec.8th |

35-35.5 |

34.5-35 |

32-32.5 |

29-29.5 |

32-32.5 |

29-30 |

|

Dec.9th |

35-35.5 |

34.5-35 |

32-32.5 |

29-29.5 |

32-32.5 |

29-30 |

|

Dec.10th |

35-35.5 |

34.5-35 |

32-32.5 |

29-29.5 |

32-32.5 |

29-30 |

|

Dec.11th |

35-35.5 |

34.5-35 |

32-32.5 |

29-29.5 |

32-32.5 |

29-30 |

【Manganese Ore】:Due to the long-term cost upside down, the miners are not in the mood to further cut prices and sell goods, and most of them are willing to pay more. The acceptance of high-priced goods is quite ordinary, and the port inventory remains high. Both the rise and fall of current manganese ore prices are difficult. The short-term manganese ore prices are mainly stable. .

3、Quotation of Mainstream Mines

|

Mine |

Specs |

October |

November |

December |

Next January |

Next February |

|

South32 |

Semi-carbonate |

4.35 |

4.35 |

3.9 |

3.8 |

|

|

Australian Manganese Ore45% |

4.5 |

4.55 |

4.25 |

4.25 |

|

|

|

Australian Manganese Ore(lumpy) 46% |

|

4.31 |

4.03 |

4.03 |

|

|

|

UMK |

South Africa Manganese Ore36% |

4.5 |

4.33 |

4.05 |

|

3.69 |

|

Comilog |

Gabonese Manganese OreMn44.5% |

4.3 |

4.3 |

3.95 |

3.95 |

|

|

Gabon SeedMn43% |

4.05 |

4.05 |

3.7 |

3.7 |

|

|

|

Tshipi |

South Africa Semi Carbonated Manganese Ore36.5% |

4.45 |

4.1 |

3.85 |

|

|

|

South Africa Manganese Ore fines34.5-35% |

|

3.6 |

3.35 |

|

|

|

|

South Africa Semi Carbonated Manganese Ore30.5% |

3.9 |

3.6 |

|

|

|

4、Port inventory of Manganese ore

As of December 14, 2020, the total inventory of manganese ore in Tianjin Port was 5.59 million tons.

(Among them: bulk cargo-5.44 million tons and containers -150,000 tons)

Arrivals this week: 161666 tons (12.4-12.11)

|

Name |

Inventory (Ten thousand tons) |

|

South Africa |

308 |

|

Gabon |

90.6 |

|

Australia |

66.6 |

|

Brazil |

33.5 |

|

The ivory coast |

16.2 |

|

Malaysia |

10.7 |

|

Ghana |

18. |

In Summary: At present, there are positive factors.The silicomanganese alloy market may continue to operate smoothly, and the possibility of price fluctuations is not ruled out. As for the future trend, it is necessary to pay close attention to changes in supply and demand relations, raw material price trends, futures performance, and Ningxia regional restrictions Related factors such as the latest developments in production.

- [Editor:zhaozihao]

Save

Save Print

Print

Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think