[Ferro-Alloys.com] LONDON (Reuters) - Bargain hunters have helped molybdenum recover after prices crashed to two-year lows, but ample supplies of the metal used to make stainless steel mean further significant gains for now are unlikely, analysts say.

Prices of the metal MLY-OXIDE-LON, valued for its anti-corrosive and strengthening properties in the oil & gas and automotive industries, fell toward $8 a lb two weeks ago.

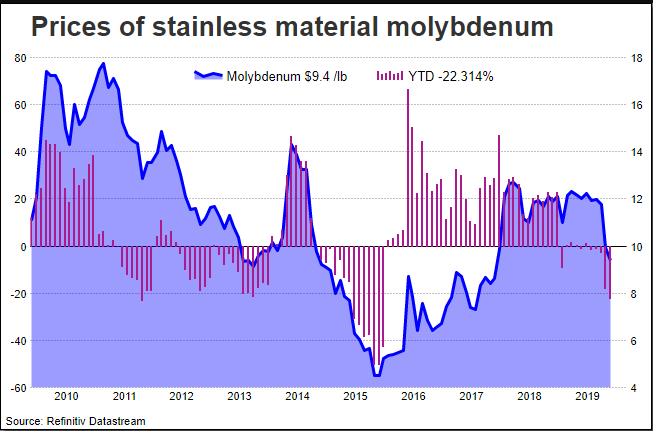

The slide started in September, triggered by one producer selling at a discount to prices in the spot market, trading sources say. A move toward $10 a lb last week prompted traders to sell into the rally. It now stands above $9 a lb.

GRAPHIC: Molybdenum prices

Until September, prices were steady around $11-$12 a lb, despite the prolonged trade dispute between the United States and China which has undermined economic activity, growth and demand globally.

“The upside is limited, it was due to trader activity. Stainless demand has underperformed this year, so demand for moly has been weak,” CRU analyst James Jeary said.

“Weak demand was offset by concern about concentrate supply from Chile and that’s why prices held up. Deteriorating moly grades are a problem in Chile, but it looks as though third-quarter production was decent.”

CRU estimates molybdenum production in Chile fell to a four-year low of 27 million lbs in the second quarter and rose to 30 million lbs in the third quarter.

Overall, expectations are for the molybdenum market estimated at around 580 million lbs to be balanced or see a small deficit this year.

Without a significant recovery in demand from steel mills, which consume about 70% of global molybdenum supply, 2020 is also likely to see a balanced market.

“People don’t want to hold inventory,” said Roskill analyst Olivier Masson. “Guidance from stainless producers is not good.”

Finland’s Outokumpu (OUT1V.HE) said recently: “The stainless steel market is expected to remain subdued. The European market is suffering from continued import pressure from Asia and low underlying demand.”

Demand for stainless is highly correlated with the auto, oil & gas and petrochemical industries, which combined account for about 45% of demand, where activity has slowed.

(Reuters FROM) - NOVEMBER 27, 2019

- [Editor:tianyawei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think