[Ferro-Alloys.com]Bushveld Minerals is to pay $17.2 million for a stake in the Vametco vanadium mine and plant, adjacent to its Brits Vanadium Project in South Africa’s North West province.

The London-listed company has signed a Share Purchase Agreement with Evraz Group for a 78.8% stake in holding company Strategic Minerals Corporation (SMC), which owns Vametco.

The acquisition is to be executed in two tranches, with the first tranche of $4.7 million for a 23% interest in SMC payable by June 17 2016. The remaining $12.5 million, payable for a 55.8% share in the company and subject to regulatory and shareholder approval, is due a year later.

‘The acquisition price of $17.2 million is, we believe, attractive for a robust operating asset and is less than 10% of the replacement value. The phased structure breaks this transaction into bite-sizes that are desirable for a company of our size, even more so in an environment of improving vanadium prices,” said Fortune Mojapelo, CEO of Bushveld Minerals.

Vametco will also accelerate the company’s path to production and the development of a vertically integrated vanadium platform. Mojapelo told Mineweb that construction of a greenfield mine and plant of a similar capacity would cost at least 10 times more, with time for construction and ramp up affecting the date of first production. The Vametco acquisition will see the company transition from a vanadium explorer to a producer, with revenue and profit generating assets at current levels, he said.

According to Bushveld Minerals, Vametco is one of the cheapest primary producers of vanadium in the world. It produced 2 419 tonnes of vanadium at all-in cash costs of $17.33 per kilogram in 2015. Its revenue and operating profit for the year amounted to R629 million and R26 724 respectively.

At current production levels, ore reserves of 27 million tonnes, as per JORC criteria, are sufficient to support operations for 24 years. Mineral resources are in excess of 135 million tonnes.

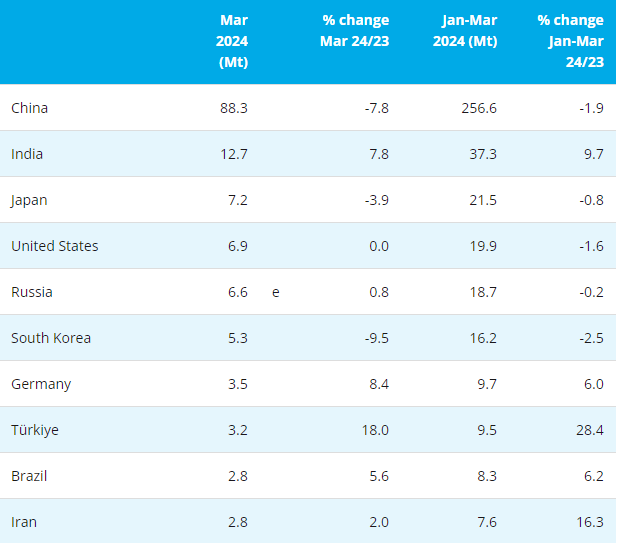

Vanadium demand is expected to remain robust, despite the precarious state of the global steel sector. A total of 90% of all vanadium produced globally is used as a strengthening agent in steel fabrication.

Mojapelo said the intensity of vanadium use in steel is growing, driven by Chinese regulations that require the use of higher strength reinforcing bars in construction. Vanadium consumption in steel increased by 8% between 2006 and 2014, compared with steel production growth of 3.6%, he said.

The company also intends to leverage off the acquisition to produce vanadium electrolytes, used in vanadium redox flow batteries, for the energy storage market. Citing recent research, Mojapelo said the energy storage sector is at a tipping point with security of supply and low battery input costs critical to unlocking value. At vanadium prices of $20 per kilogram, he said the value of the entire vanadium market is around $2 billion whereas the energy storage market is expected to grow to $350 billion by 2030. “Even if vanadium gets 20% of that market, it is too big to ignore. We have the benefit of looking at it from the safety of supply into steel,” said Mojapelo.

Under AIM rules, the Vametco acquisition will be classified as a reverse takeover. The company is at an ‘advanced stage in negotiations with funding partners with regard to a placing of new shares in Bushveld and/or co-investment in Bushveld Vametco Limited’ and will soon explain how the acquisition will be funded.

Article from Internet for Reference

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:Sophie]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think