The 21st century will see emerging markets dominate the world.

Incredibly, emerging markets already contribute half of the world’s GDP — a portion which will only increase. Ken Wangdong, our Emerging Markets Analyst, is well aware of this trend. And he’s making his subscribers some big gains from it…you can check out his work here.

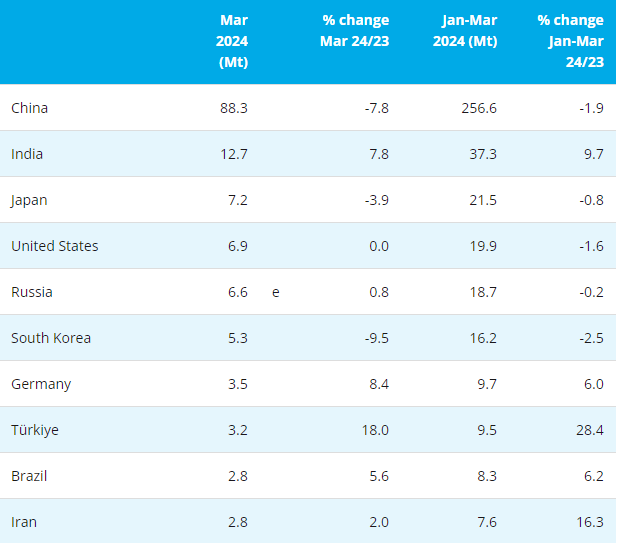

Like myself, Ken realises that sooner rather than later, we’ll see a change of the guard — the US Empire will be surpassed by China. In my view, the Chinese economy will double in size over the next decade.

And this means greater demand for commodities. Indeed, we’re only half way through this multi-year commodities super-cycle.

China is a growing powerhouse, there’s no doubt about it.

China’s population totals over 1.3 billion people — enough to fuel its own economy. This is why China is transitioning from an investment-driven (i.e. infrastructure growth) to a consumer driven economy (i.e. services growth).

While the economic shift occurs, one resource which will benefit the most — nickel.

Unlike most other commodities, China requires nickel for both its investment and consumer driven economies. People are demanding a better standard of living. This means more home appliances, vehicles, electronics, new factories, and restaurants…all dependent on nickel.

Nickel will be the hottest sector this year and next year. I explain why here.

Chinese NPI production to fall by 30% this year

A fortnight ago, I discussed the impacts on the Indonesian raw nickel ban export policy.

Needless to say, China wasn’t even slightly impressed with Indonesia’s decision.

China is the world’s largest producer and consumer of nickel. So it’s worthwhile noting that, unlike other commodities such as iron ore, China consumes much of the nickel it produces. It needs all the nickel that it can get its hands on.

Thankfully for the Chinese, Philippine exporters stepped in to meet the demand.

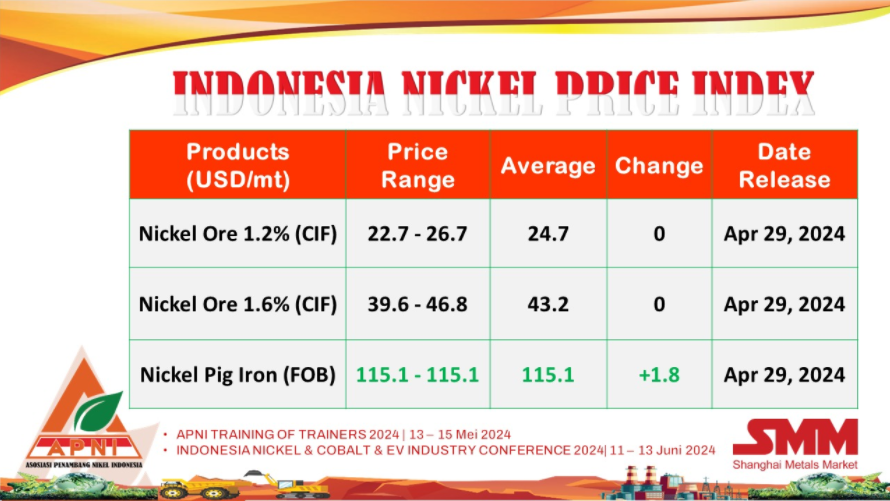

The Filipino’s provided China’s NPI (nickel pig iron) producers with a critical lifeline — supplying the nickel ore that it needs. NPI is used in the production of stainless steel. It’s a cheaper alternative to the refined nickel that you’ll find at the London Metal Exchange (LME) warehouses, and ferronickel in China.

Whilst this may sound like great news for the Chinese, there’s one big problem that’s looming — declining nickel ore stockpiles.

Chinese NPI producers are running out of higher grade Indonesian nickel ore stockpiles. The Chinese realise that this is coming. And because Indonesian ore is lower quality, they’ve been blending both ingredients to get the desired product.

But the blending operation simply won’t last.

Around June, the Chinese should start running out of Indonesian stockpiles.

The question then becomes, what happens next?

Given the nickel environment, it’s likely that the Chinese will rely solely on the lower grade Filipino nickel ore. However, doing so should see NPI production decline by 30% this year. This isn’t great news in the face of rising stainless steel demand.

When Indonesian inventories are out, we’re likely to see the nickel spot price start to shoot up towards US$16,000 per tonne. This should happen within the next five months. Depending on the demand situation later this year, we could see the nickel price hit US$20,000 per tonne by year’s end.(Money Morning)

- [Editor:Yueleilei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think